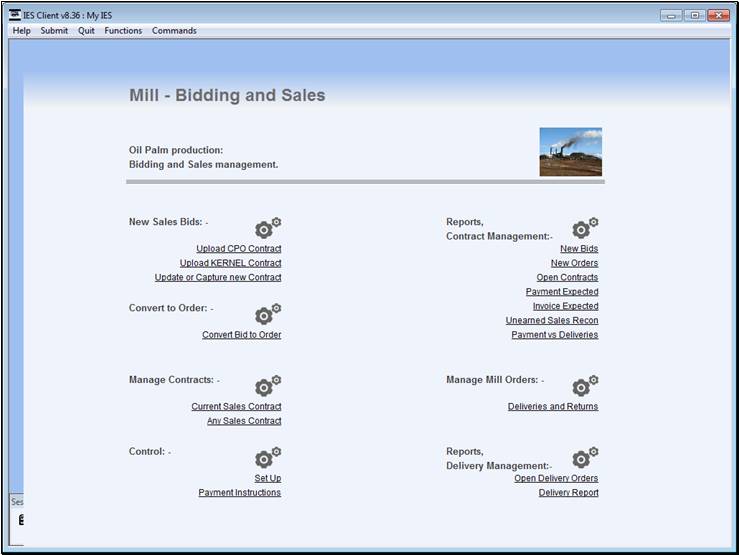

Slide 1 - Slide 1

Slide notes

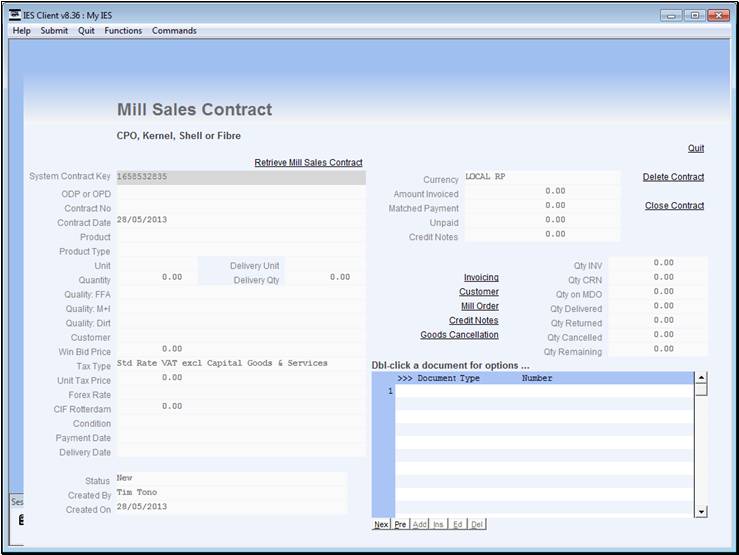

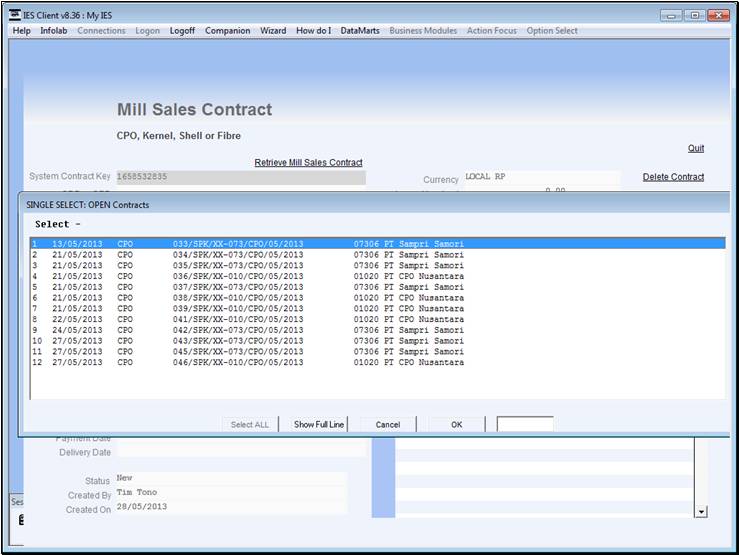

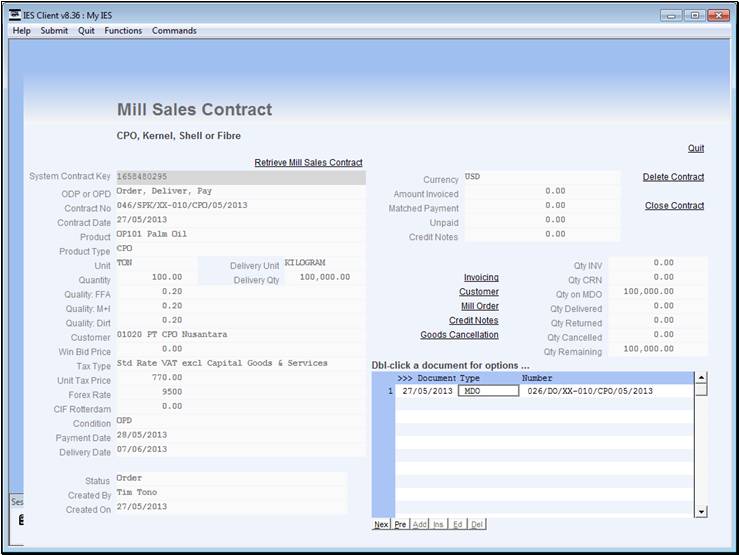

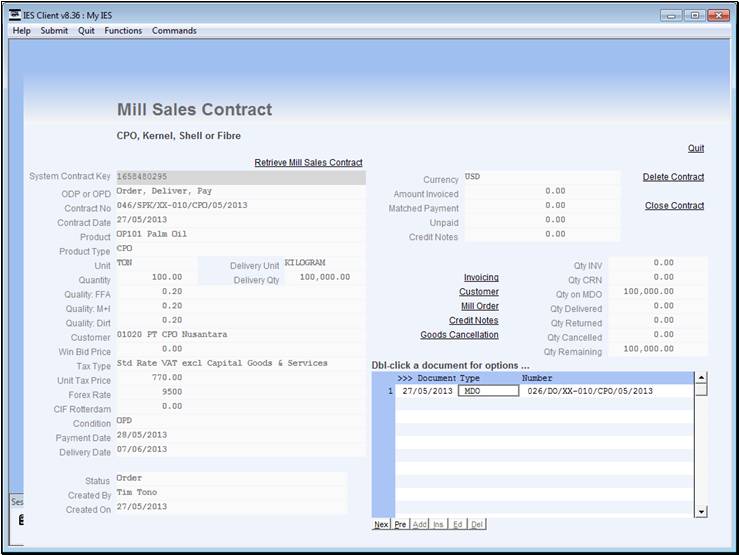

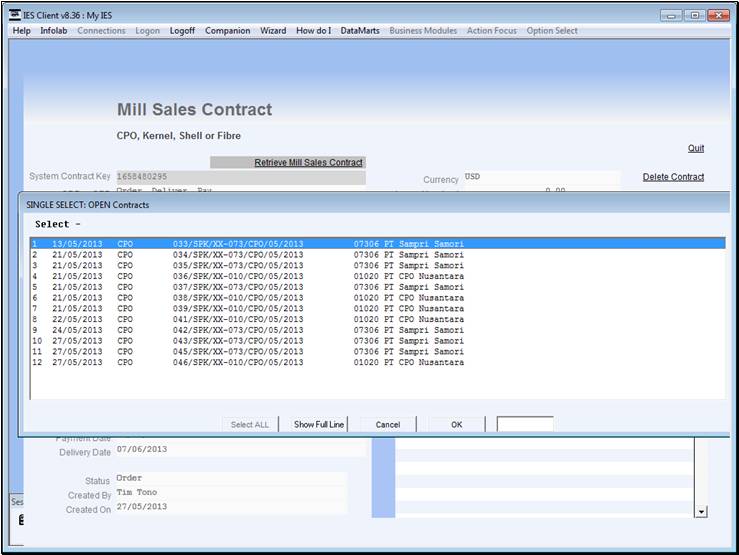

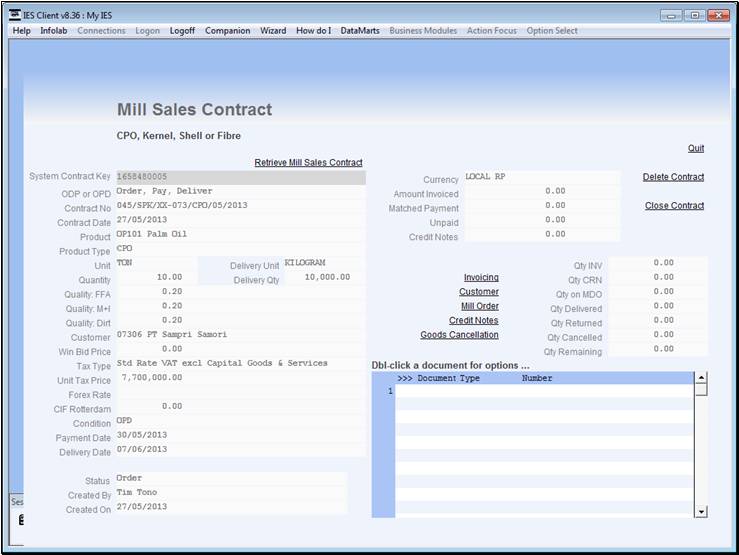

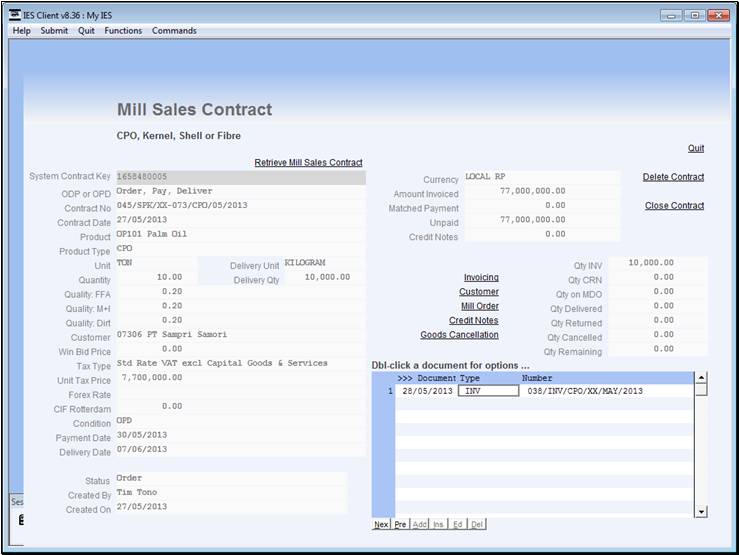

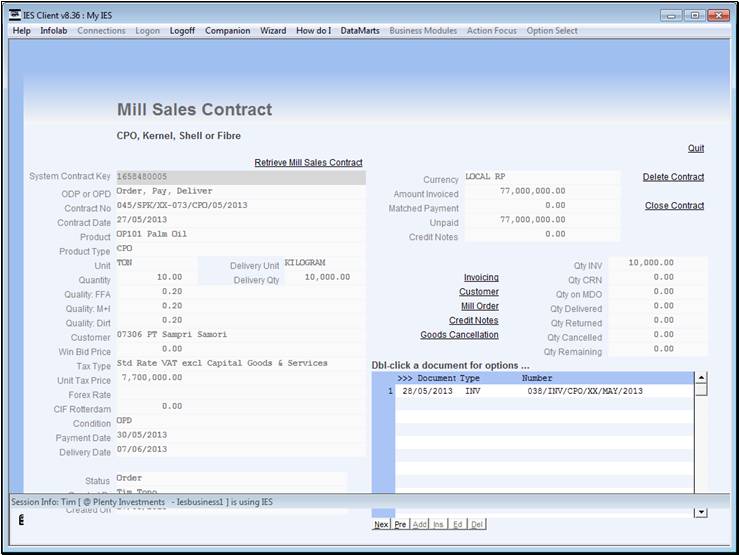

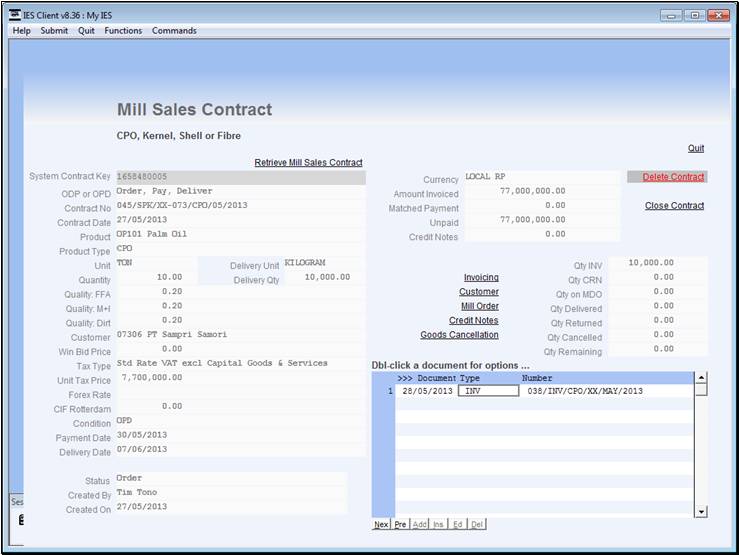

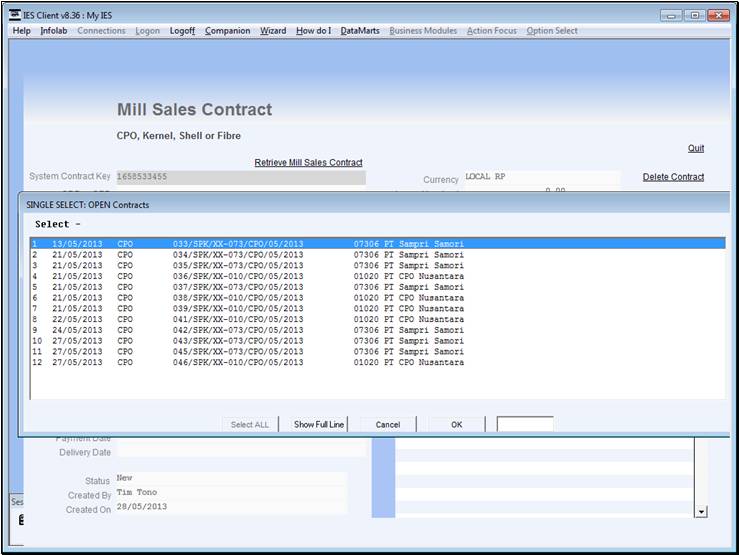

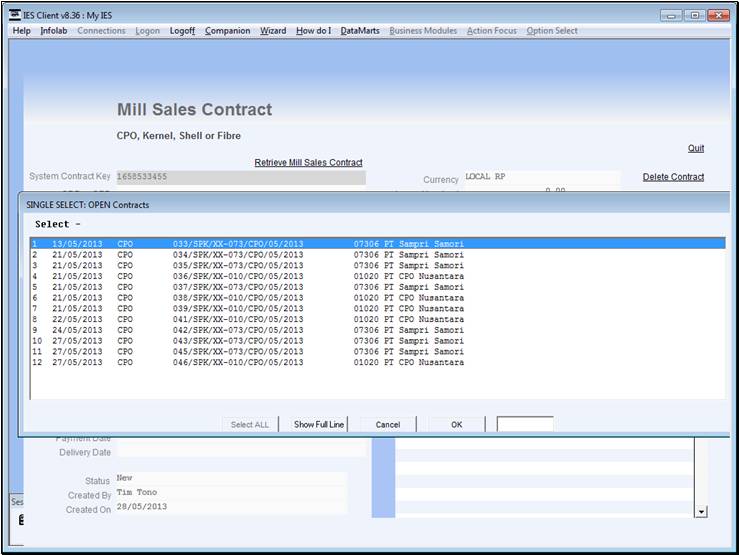

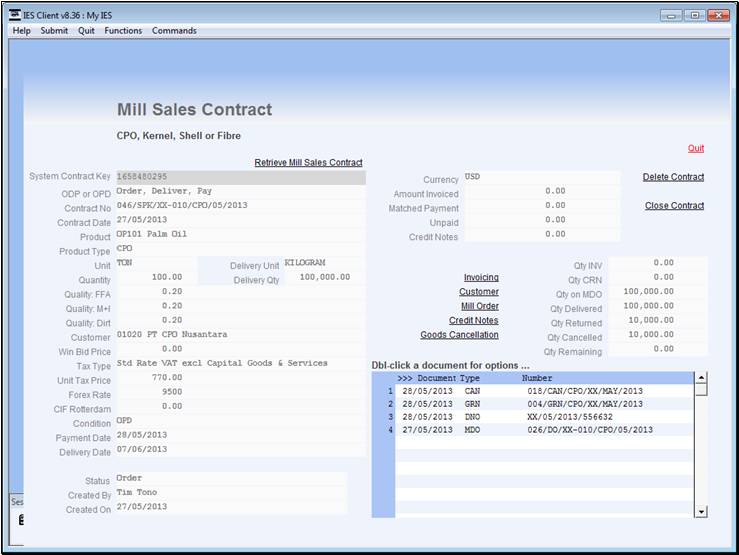

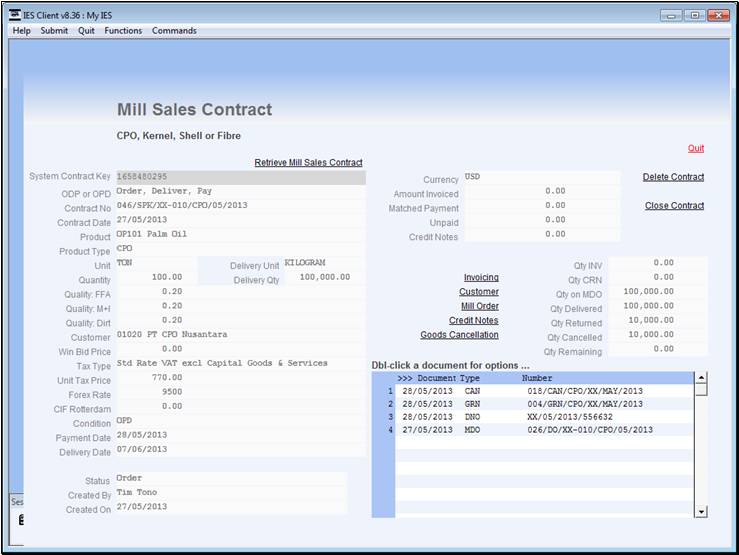

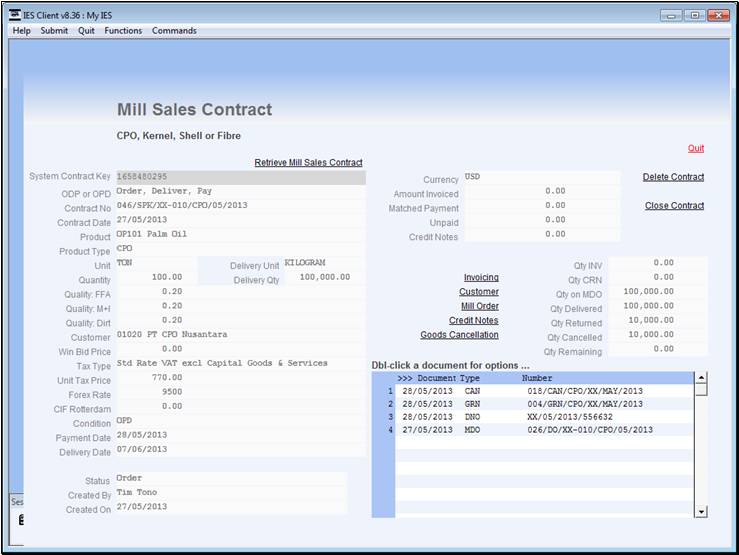

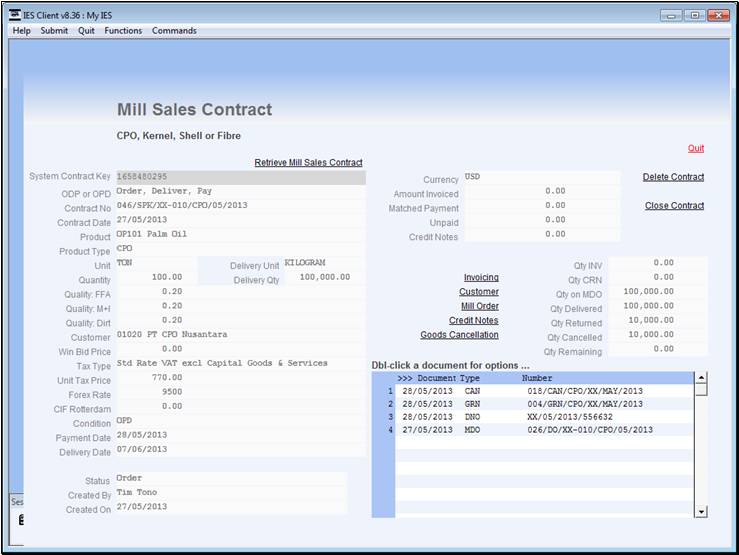

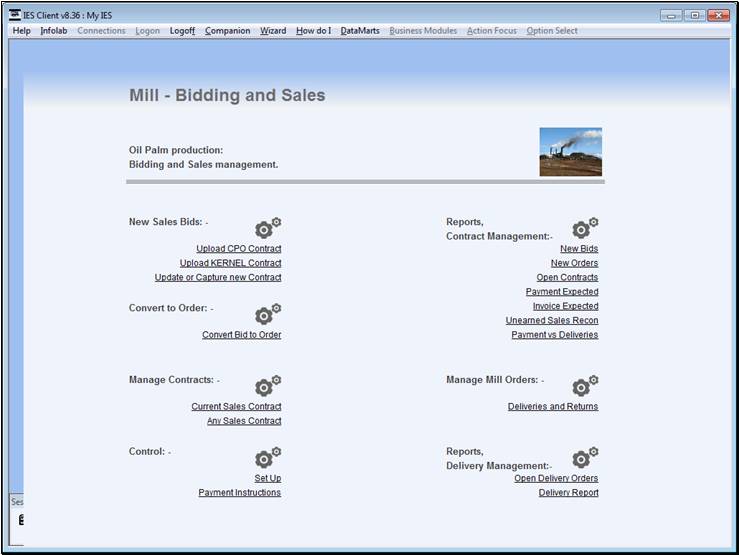

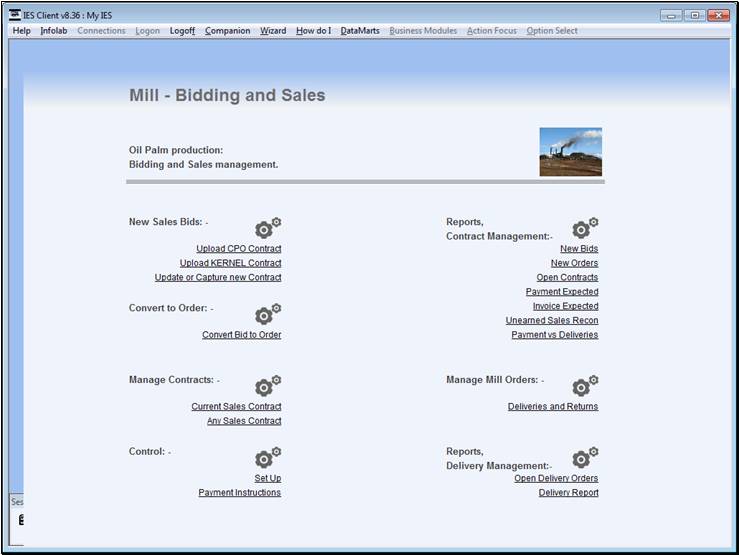

We always Invoice from a Current Sales Contract.

Slide 2 - Slide 2

Slide notes

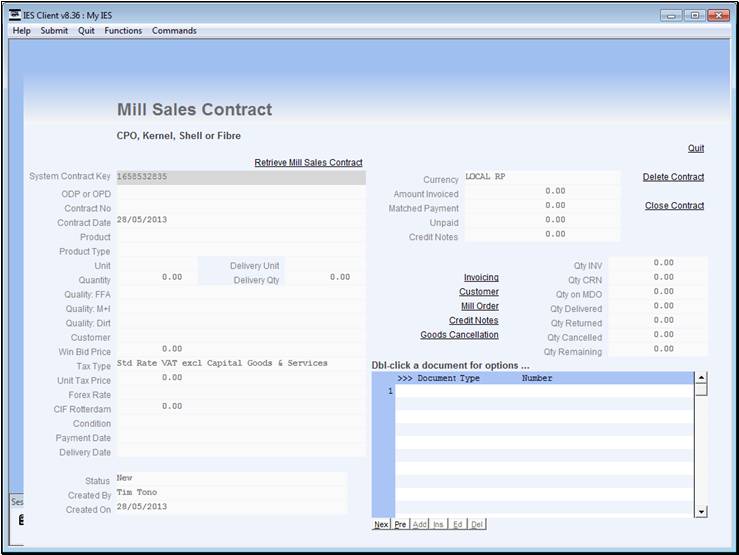

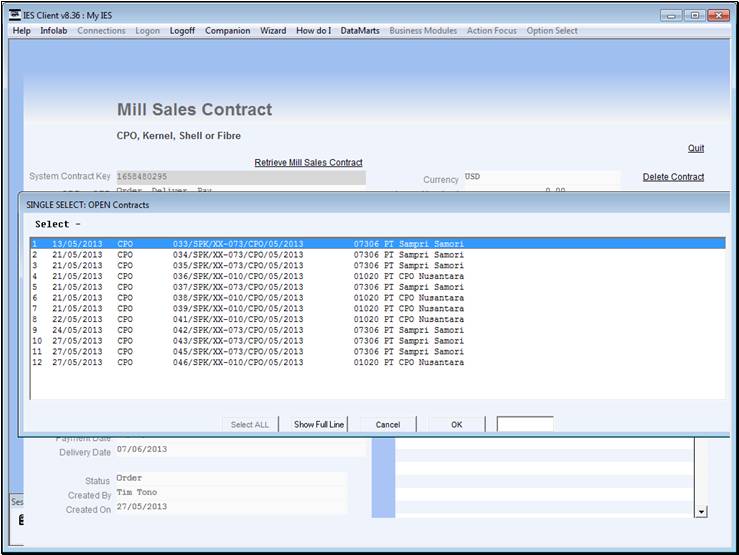

Slide 3 - Slide 3

Slide notes

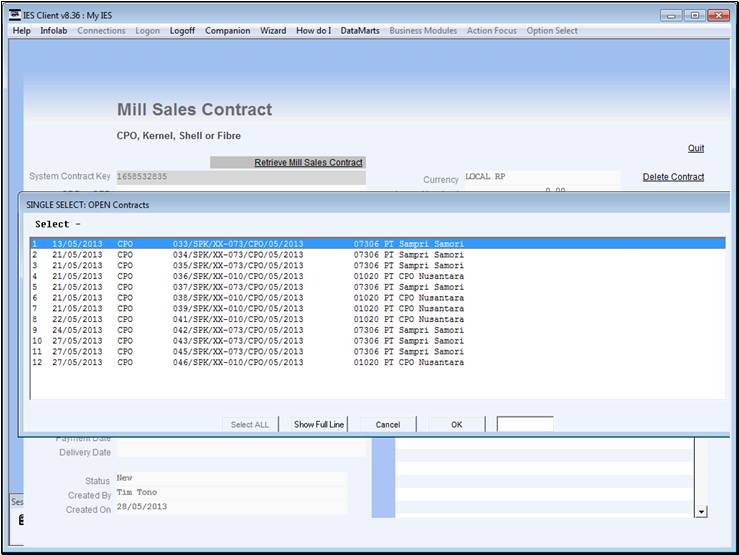

Slide 4 - Slide 4

Slide notes

Slide 5 - Slide 5

Slide notes

Slide 6 - Slide 6

Slide notes

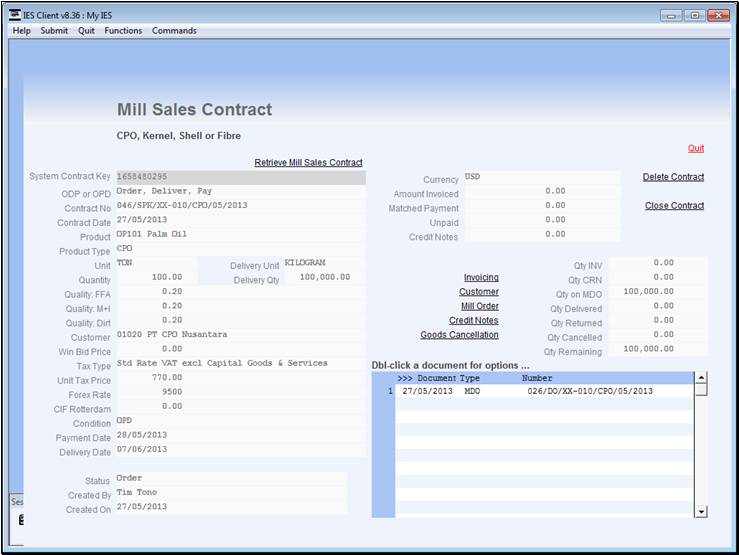

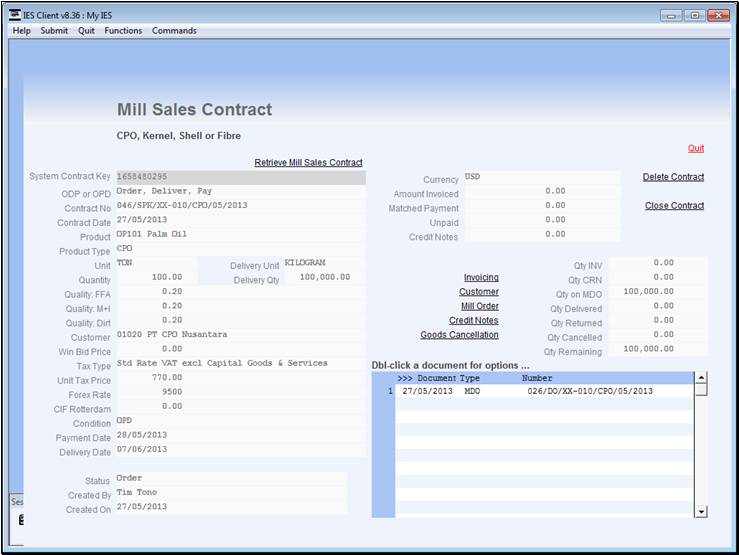

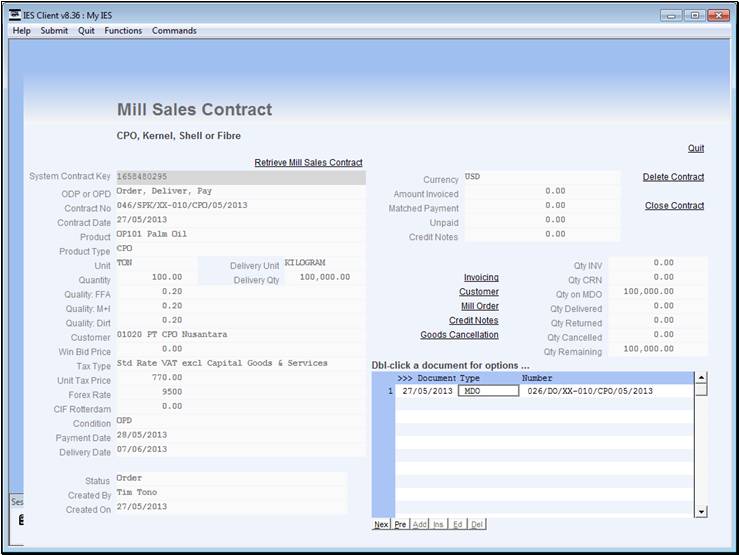

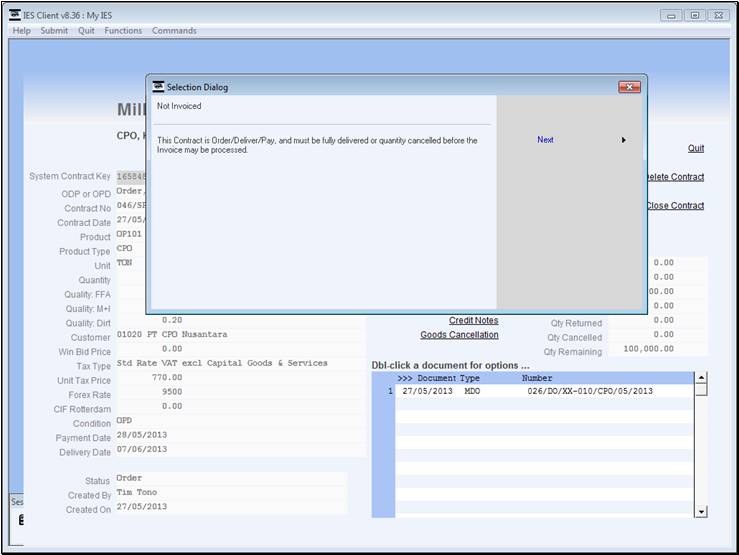

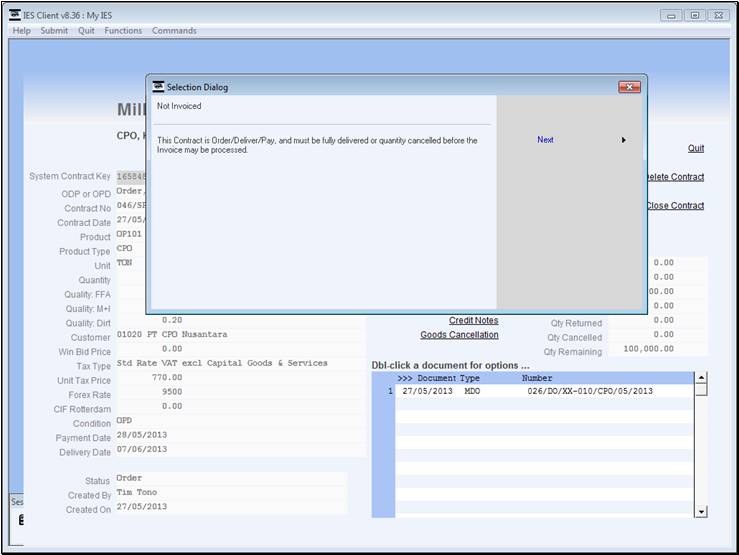

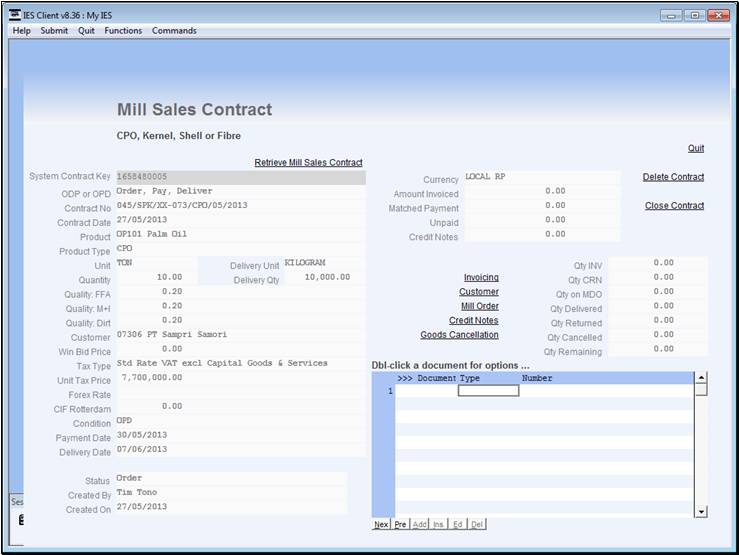

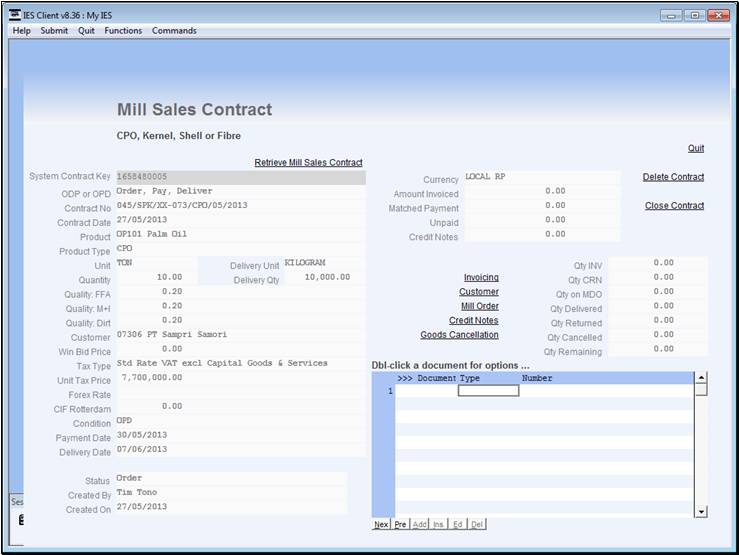

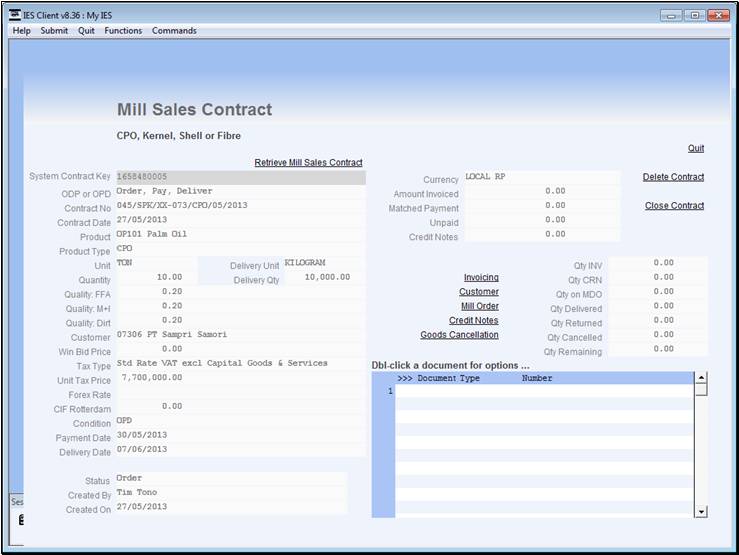

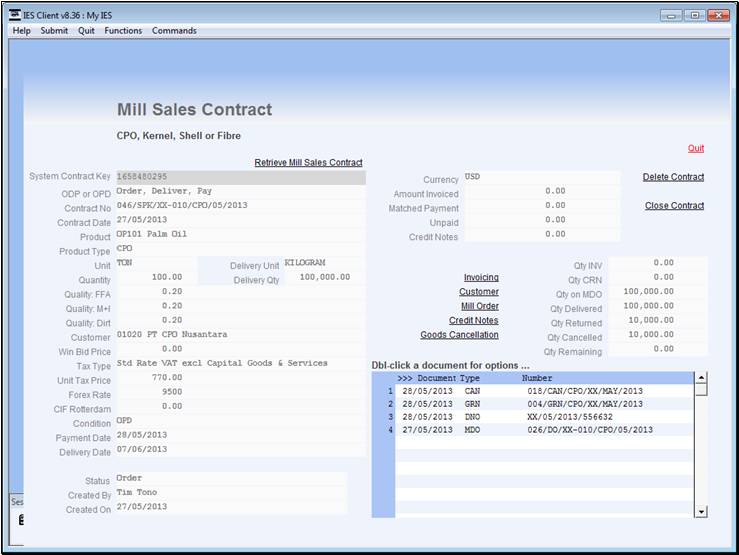

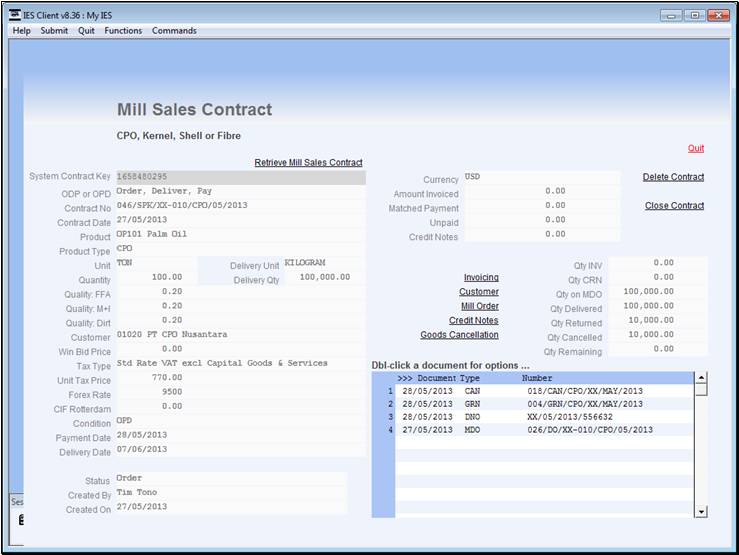

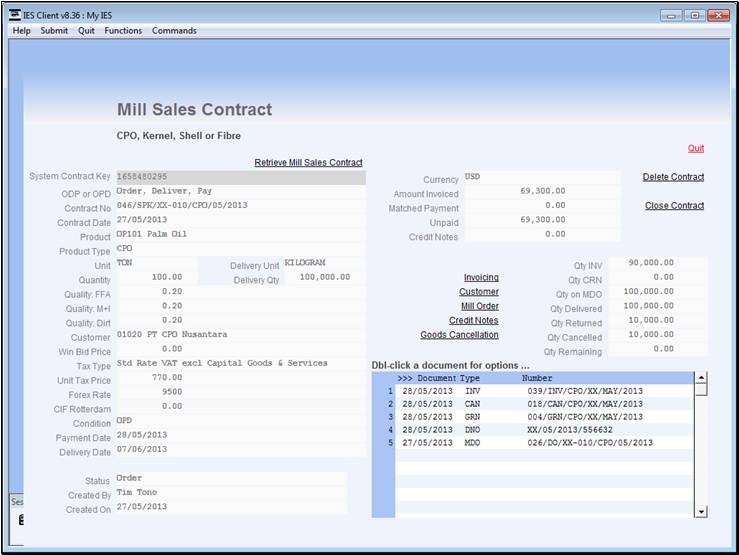

We notice that this Contract is Order/Deliver/Pay

and therefore we will not perform the Invoice until all quantity has been

delivered.

Slide 7 - Slide 7

Slide notes

Slide 8 - Slide 8

Slide notes

Slide 9 - Slide 9

Slide notes

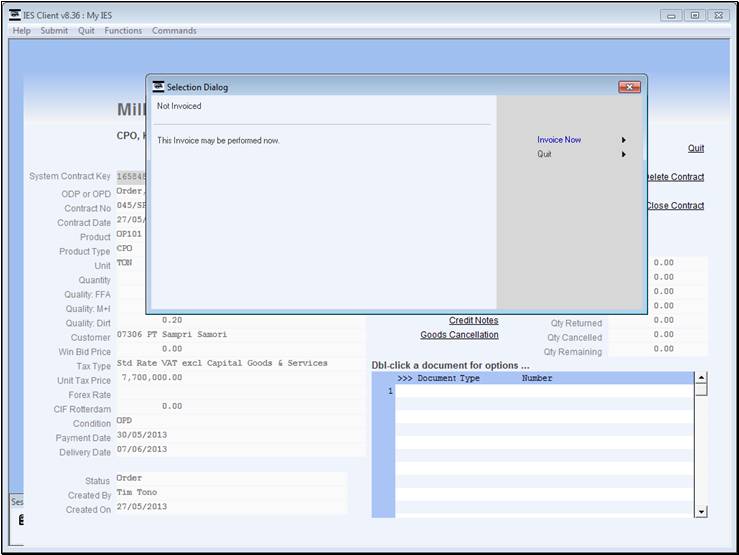

As we can see, it is not yet the right time to

perform the Invoice on this Contract.

Slide 10 - Slide 10

Slide notes

Slide 11 - Slide 11

Slide notes

Slide 12 - Slide 12

Slide notes

Slide 13 - Slide 13

Slide notes

Slide 14 - Slide 14

Slide notes

Slide 15 - Slide 15

Slide notes

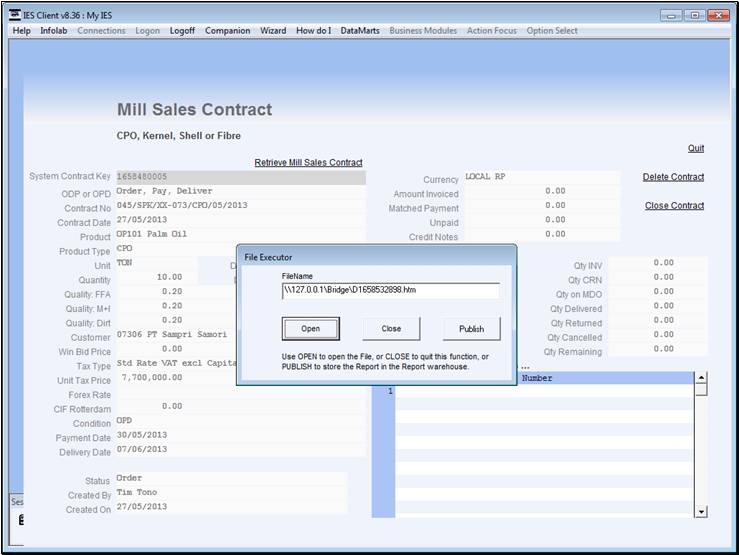

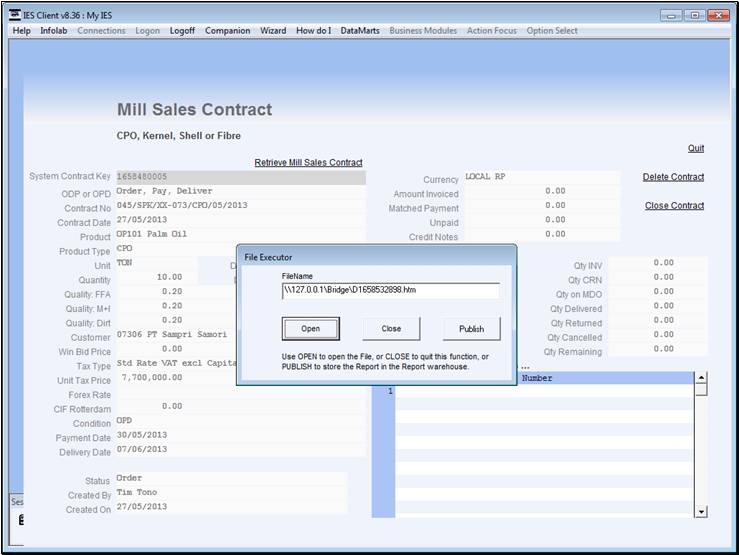

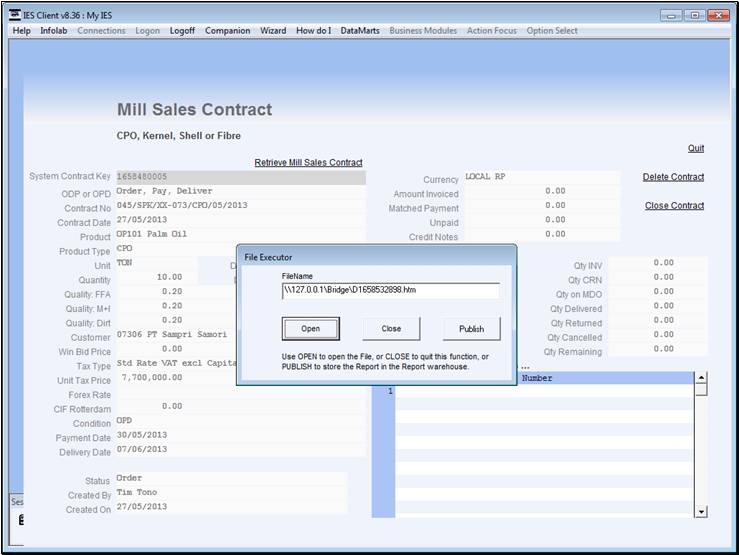

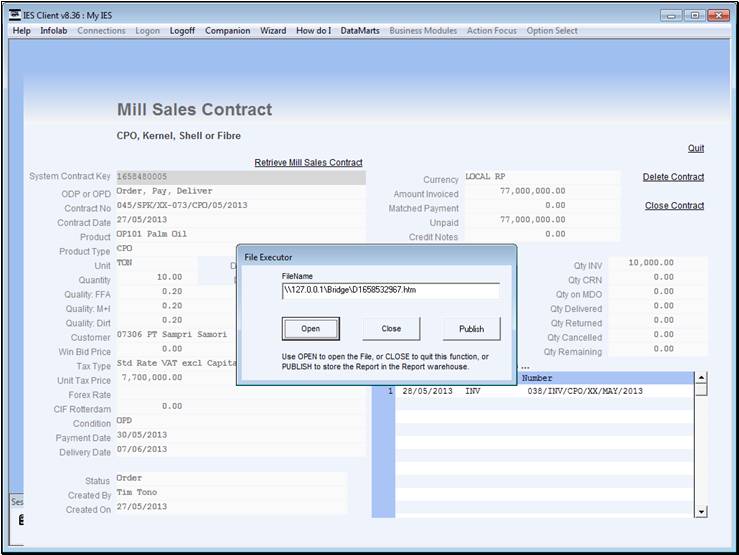

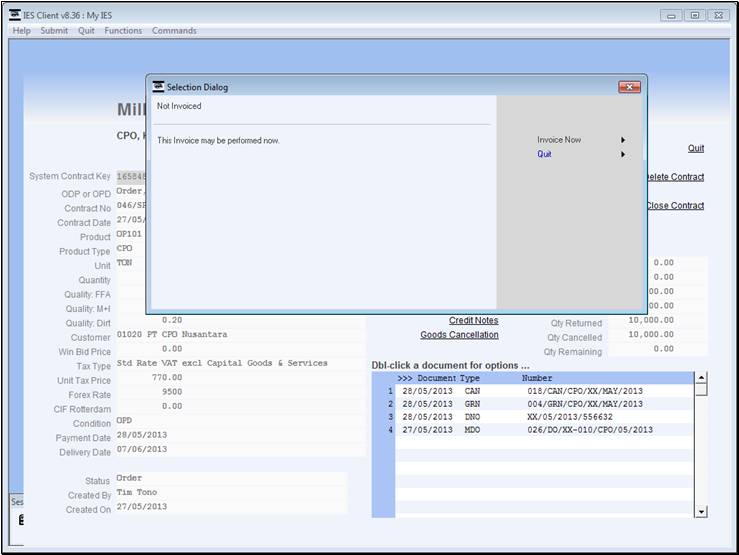

In this example, the Contract is Order/Pay/Deliver

and Invoicing is the first step to perform.

Slide 16 - Slide 16

Slide notes

Slide 17 - Slide 17

Slide notes

Slide 18 - Slide 18

Slide notes

Slide 19 - Slide 19

Slide notes

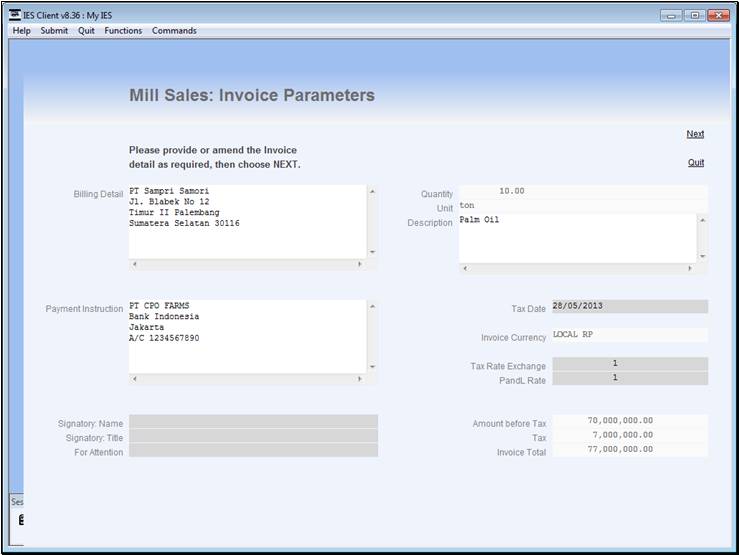

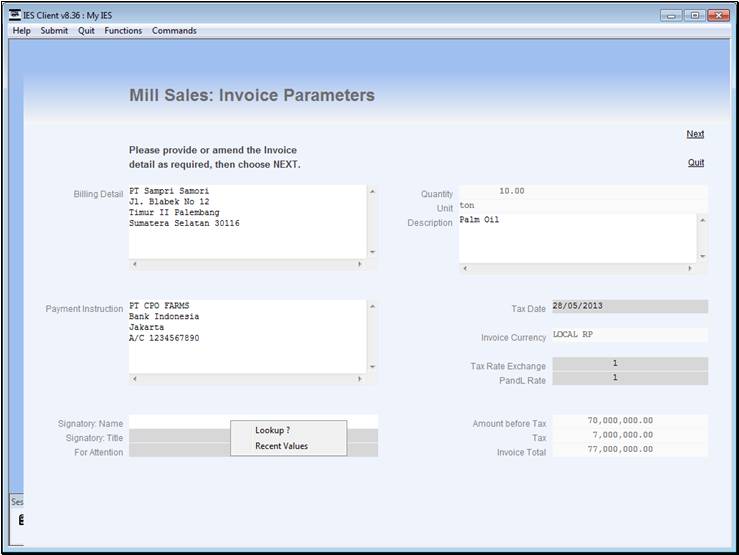

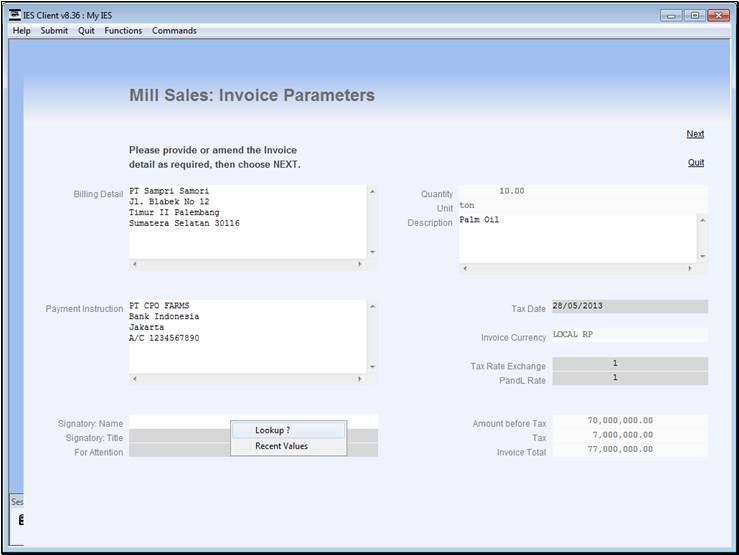

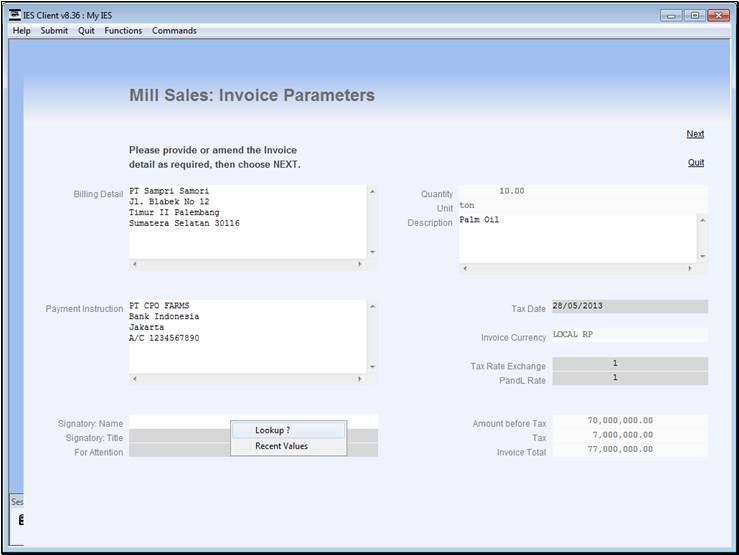

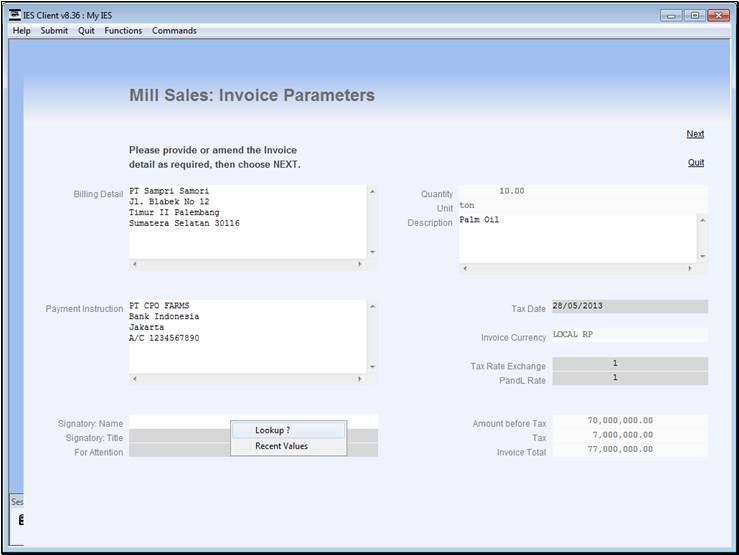

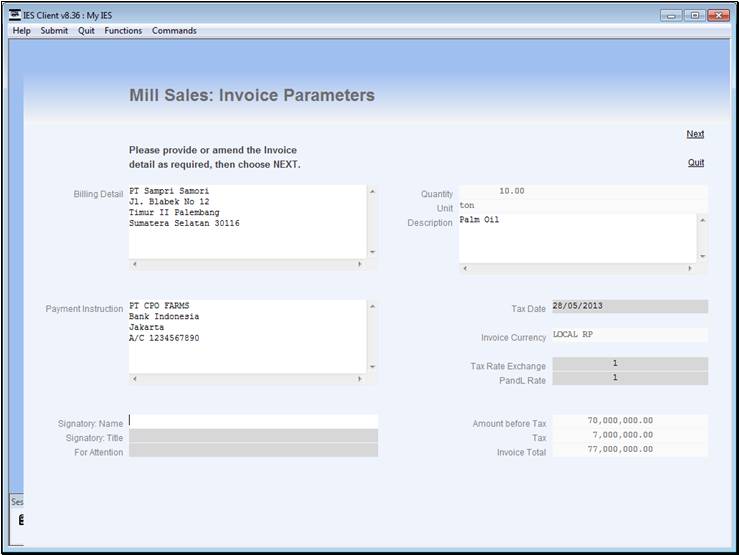

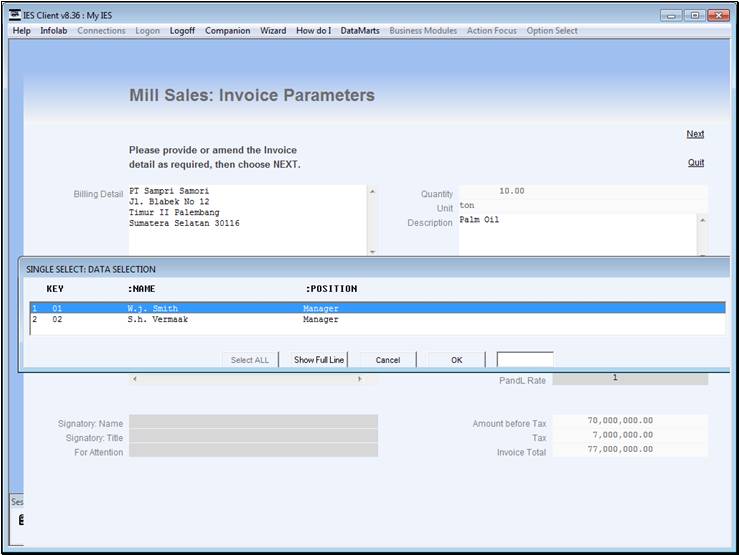

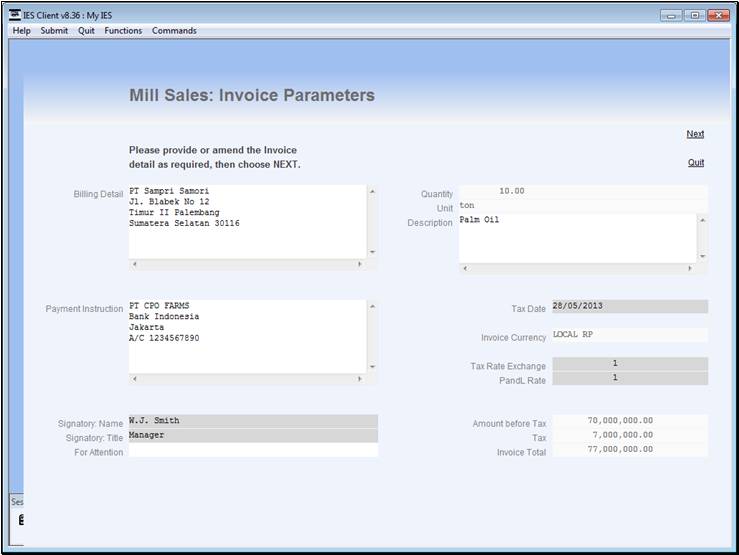

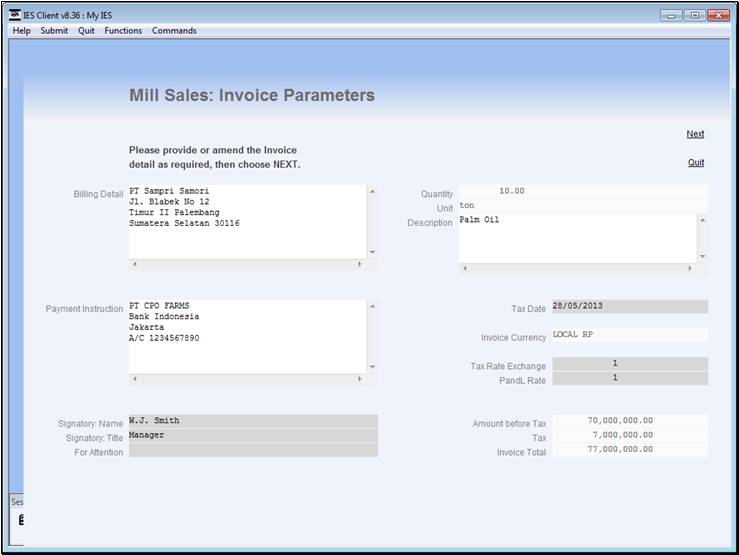

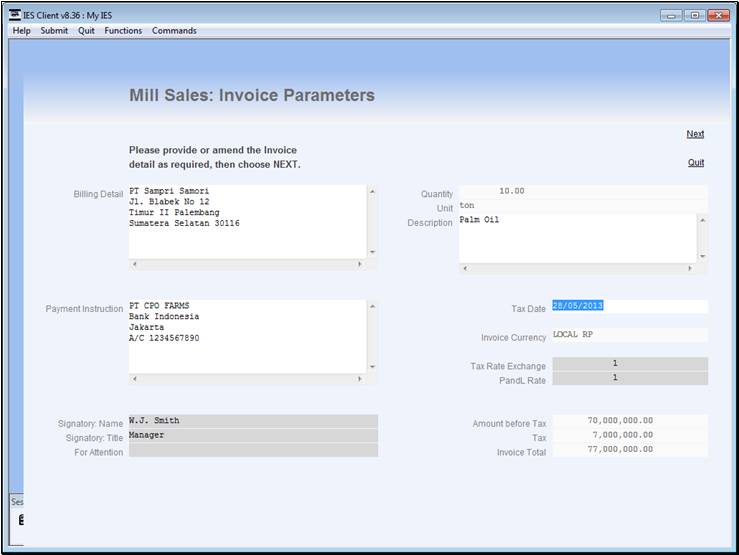

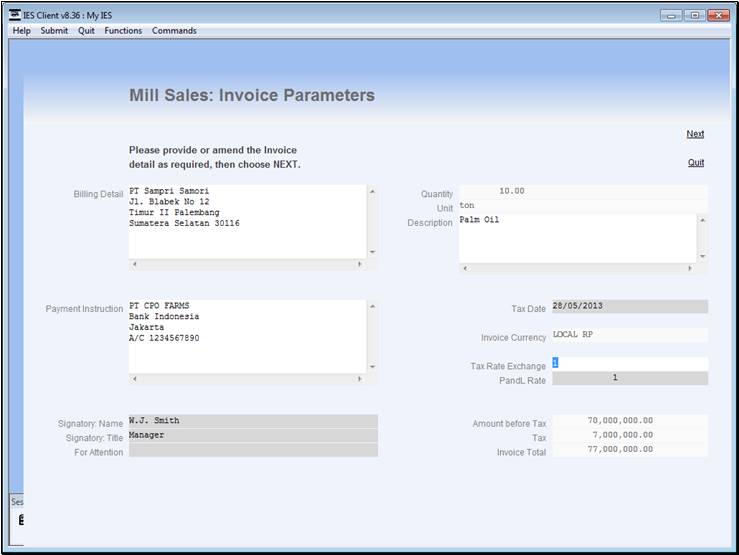

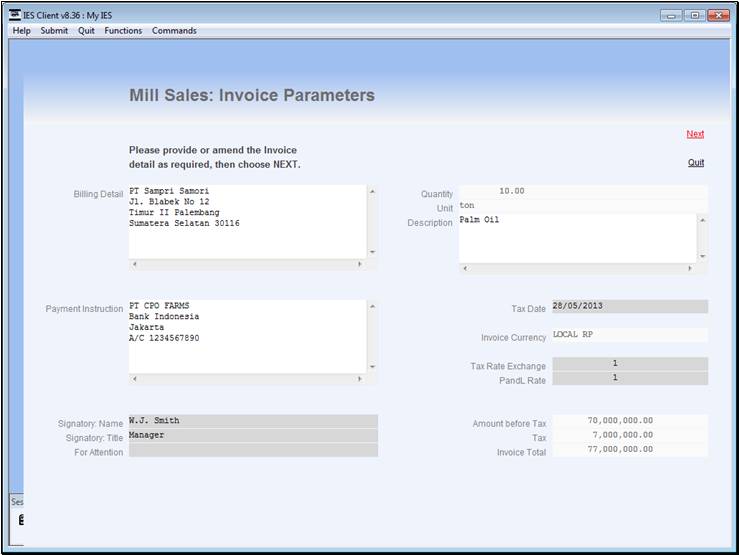

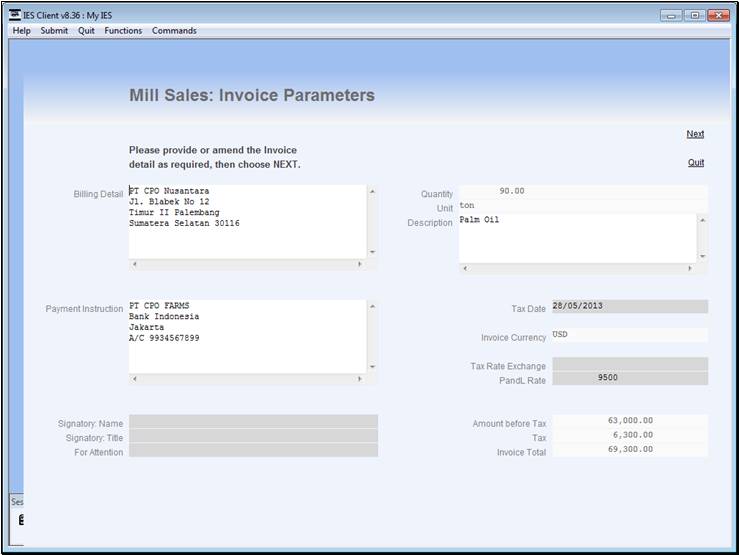

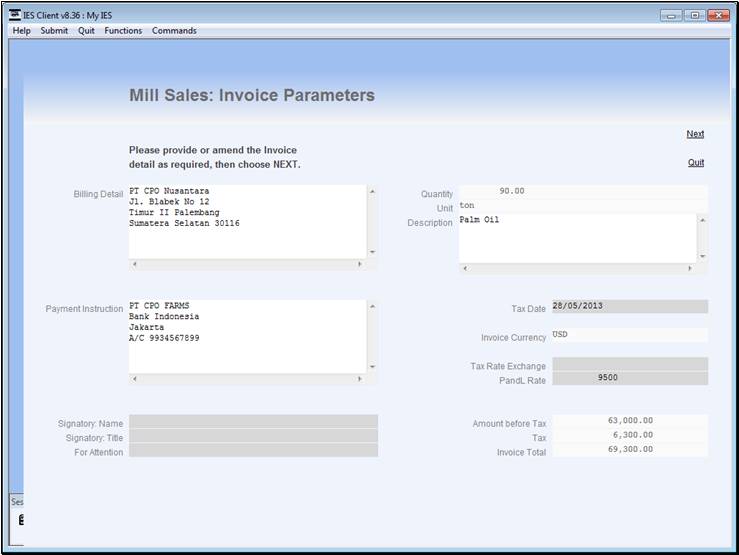

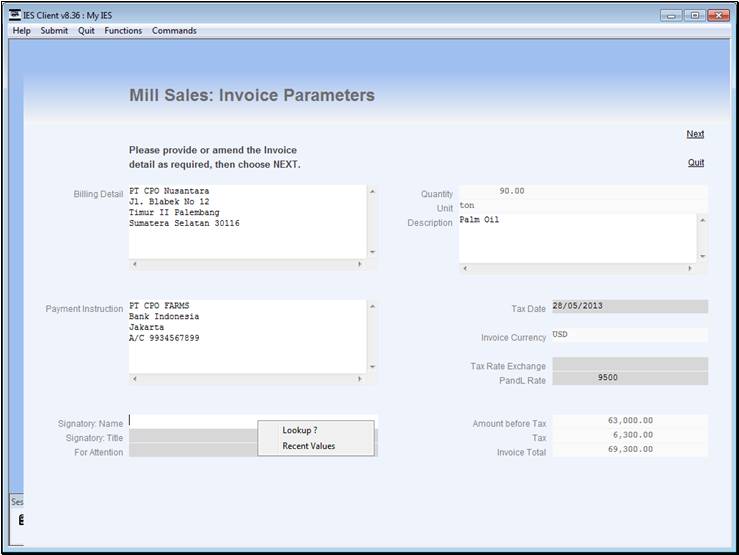

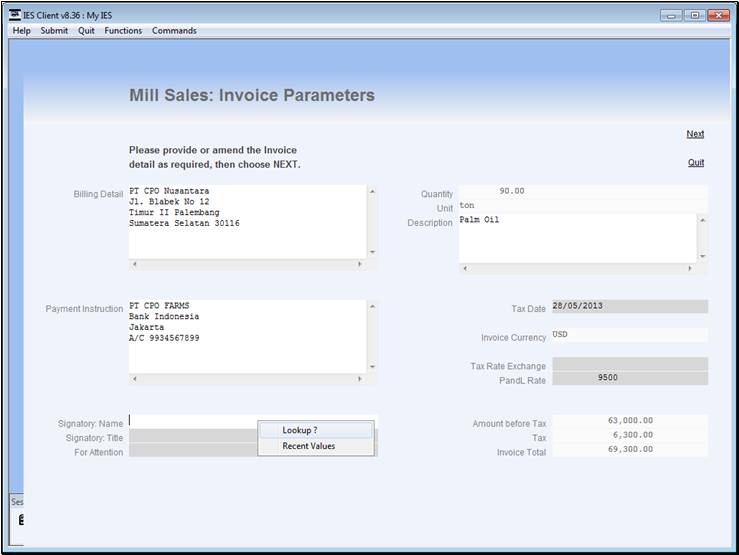

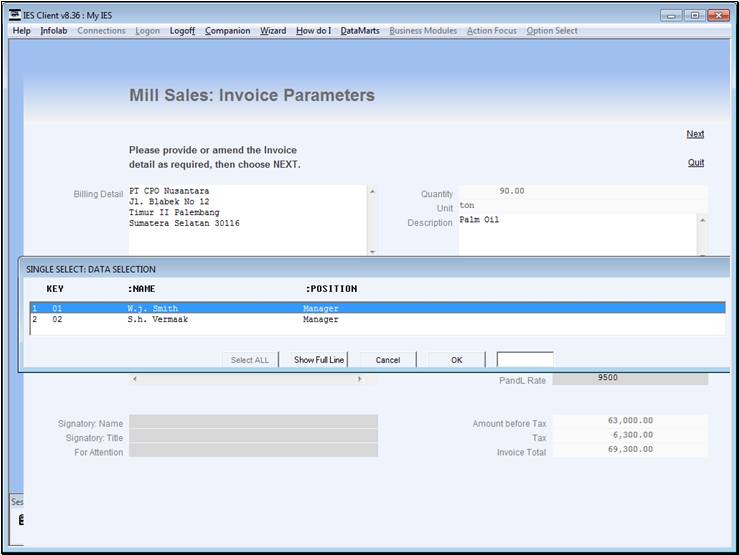

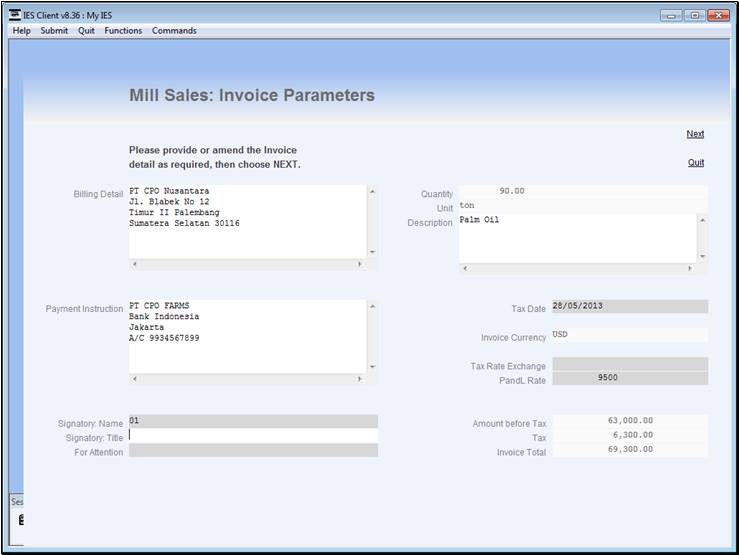

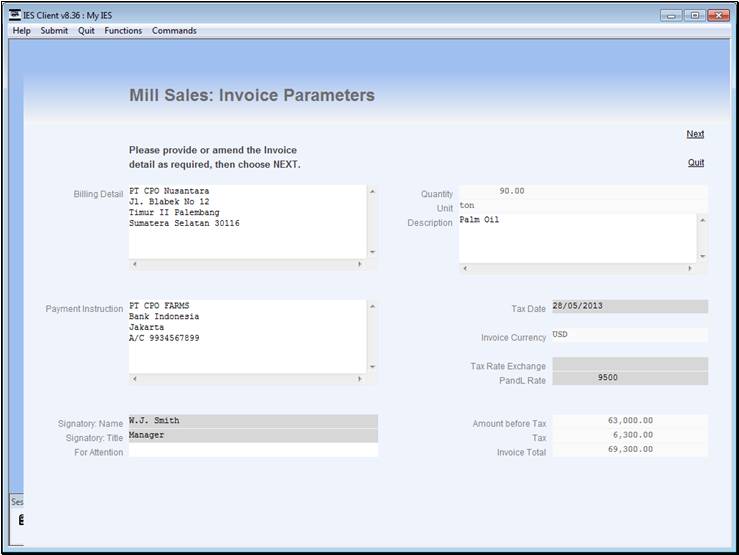

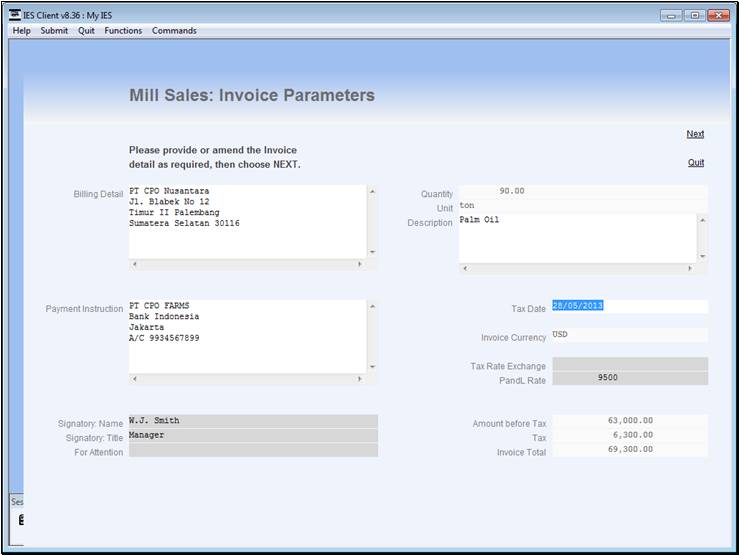

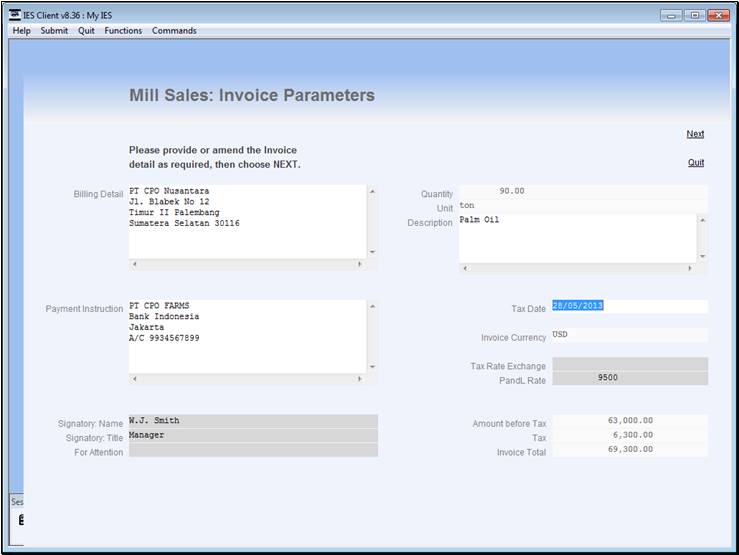

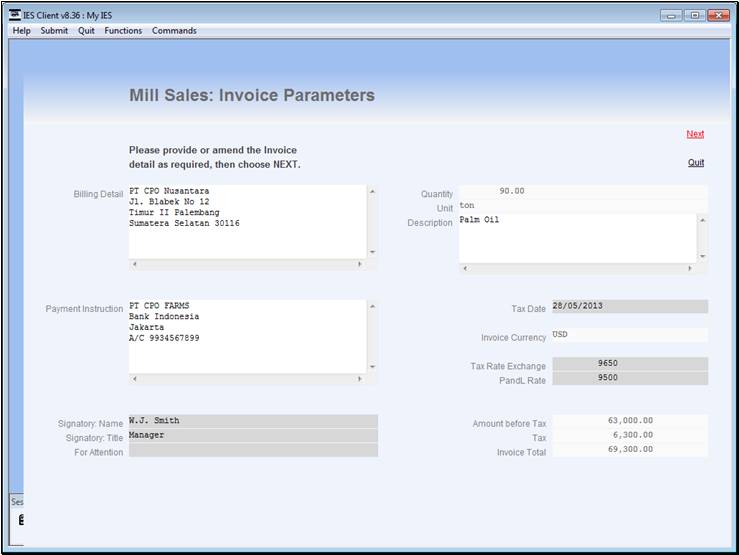

We need to select the Signatory, and we may

indicate 'for attention' if necessary.

Slide 20 - Slide 20

Slide notes

Slide 21 - Slide 21

Slide notes

Slide 22 - Slide 22

Slide notes

Slide 23 - Slide 23

Slide notes

Slide 24 - Slide 24

Slide notes

Slide 25 - Slide 25

Slide notes

Slide 26 - Slide 26

Slide notes

Slide 27 - Slide 27

Slide notes

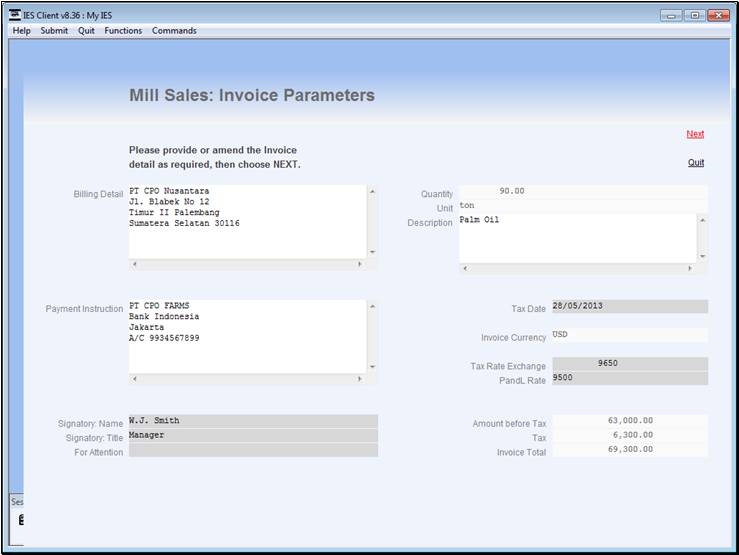

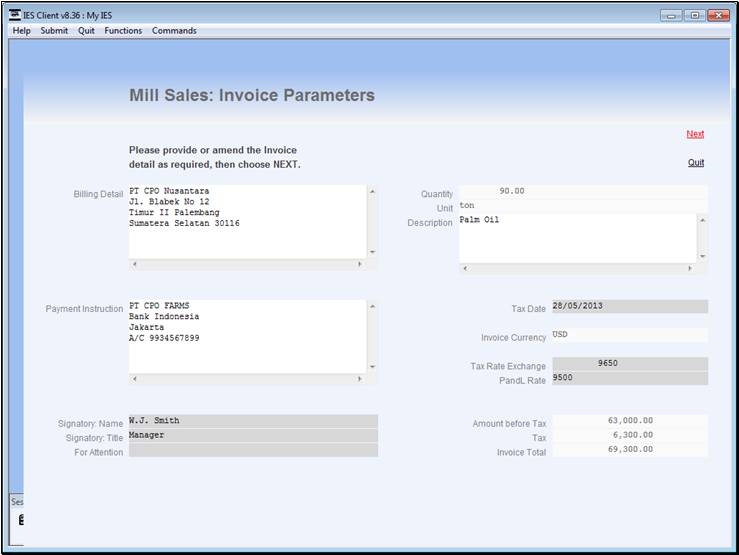

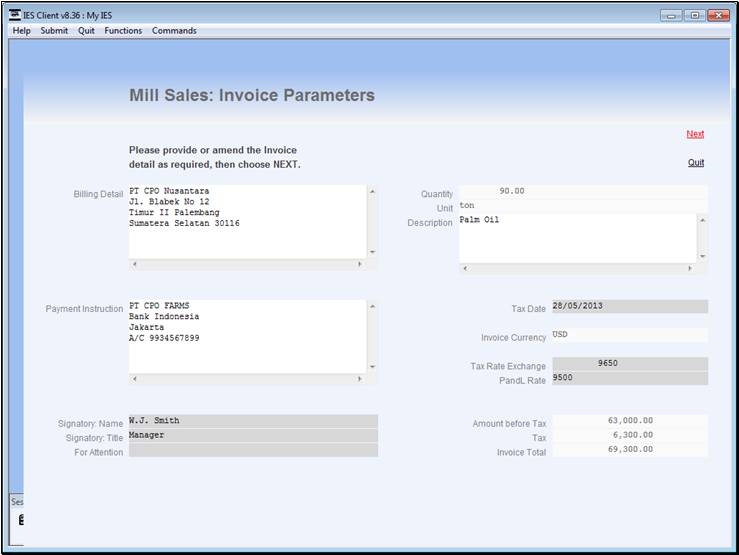

The description is probably correct, but may be

expanded if so desired.

Slide 28 - Slide 28

Slide notes

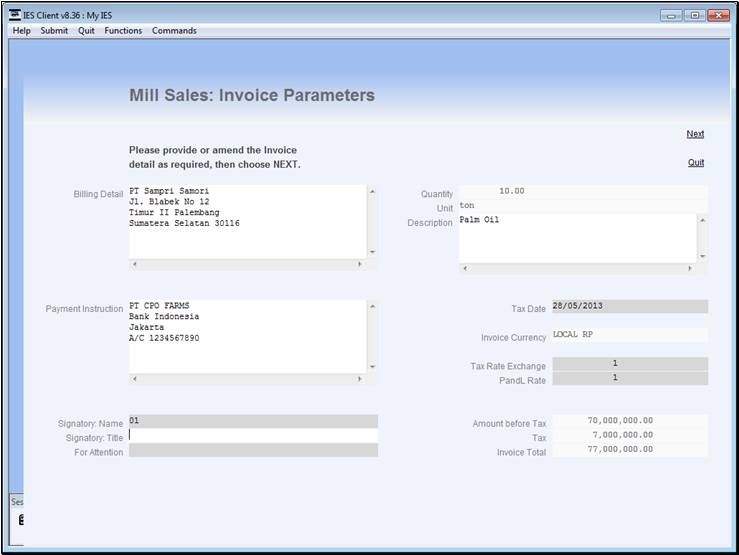

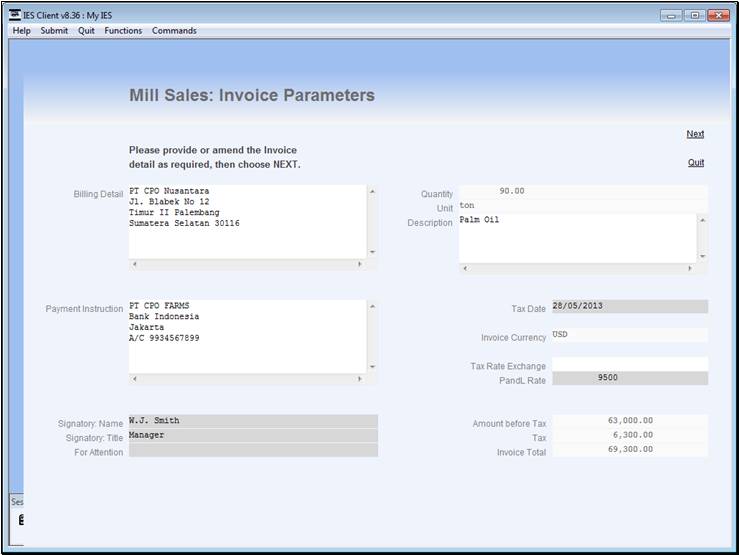

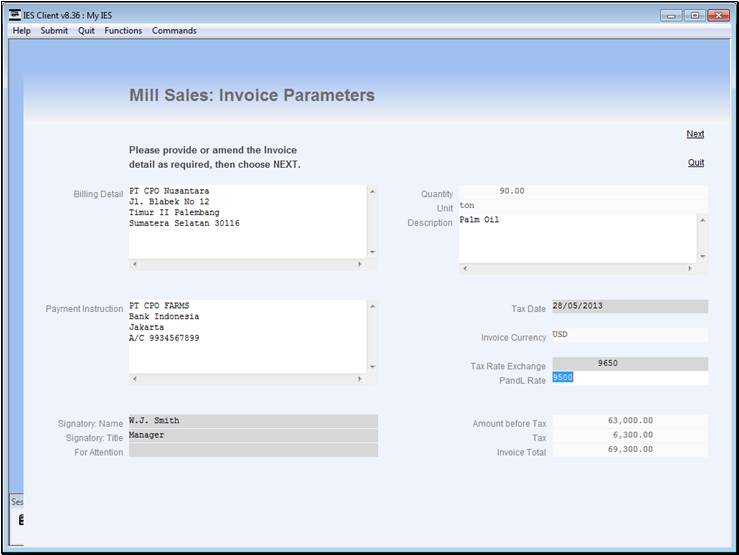

The Tax Date is critical, and can be changed if not

already correct.

Slide 29 - Slide 29

Slide notes

In the case of a Local Currency Contract, the

Exchange Rate is 1 and cannot be changed.

Slide 30 - Slide 30

Slide notes

Slide 31 - Slide 31

Slide notes

Slide 32 - Slide 32

Slide notes

Slide 33 - Slide 33

Slide notes

Slide 34 - Slide 34

Slide notes

Slide 35 - Slide 35

Slide notes

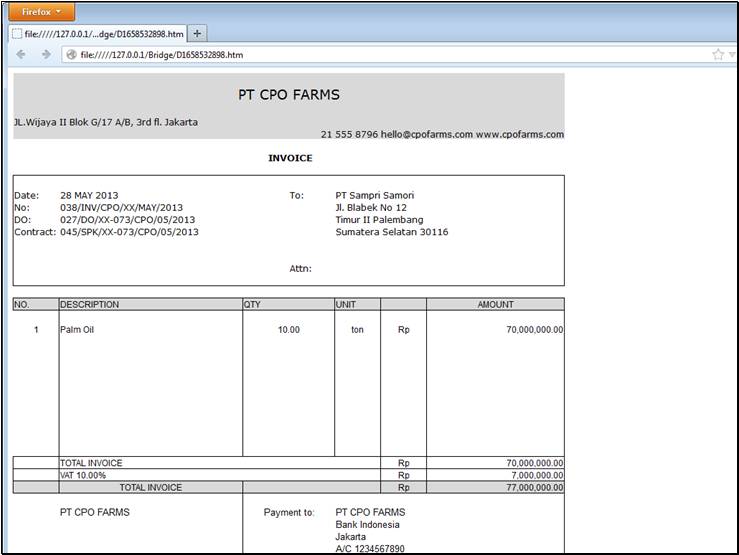

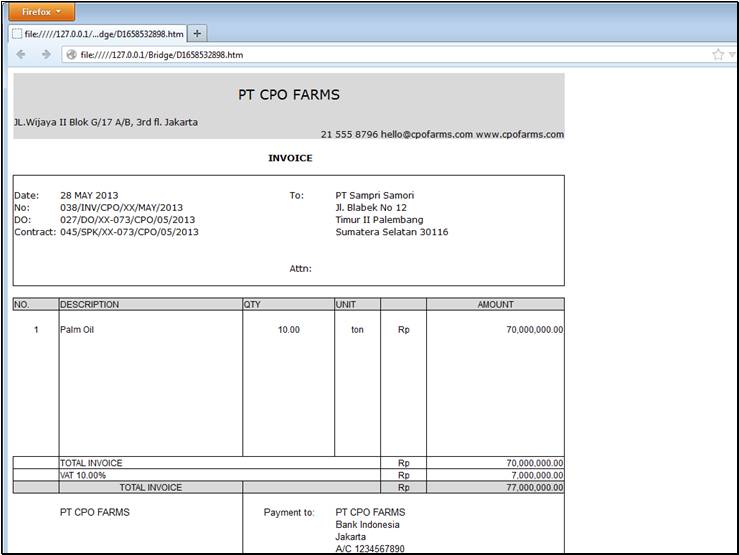

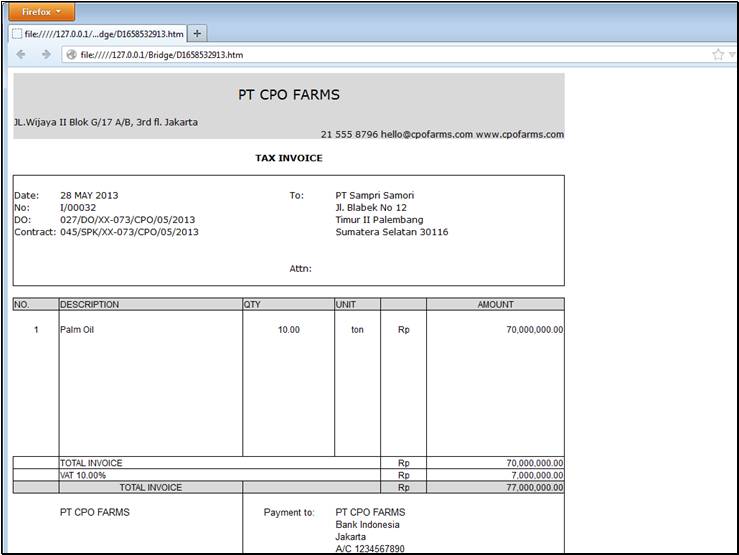

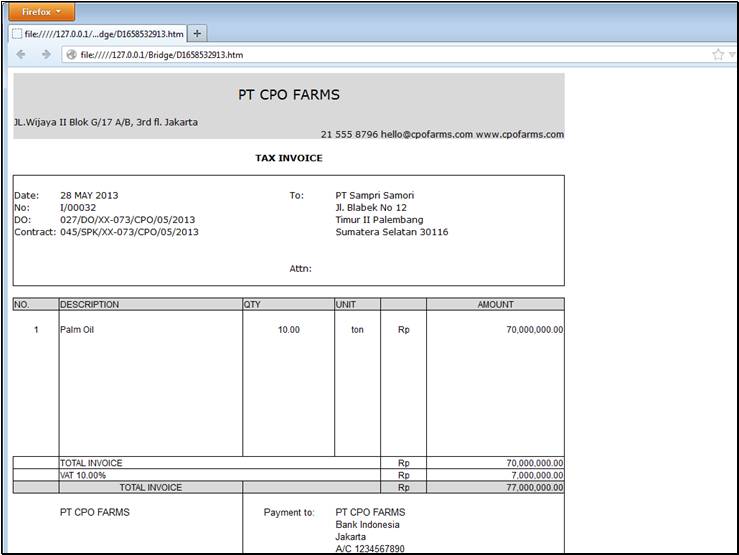

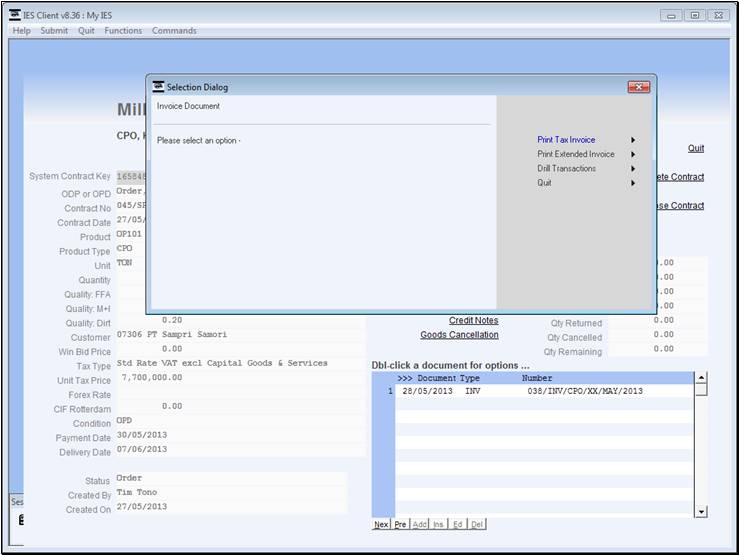

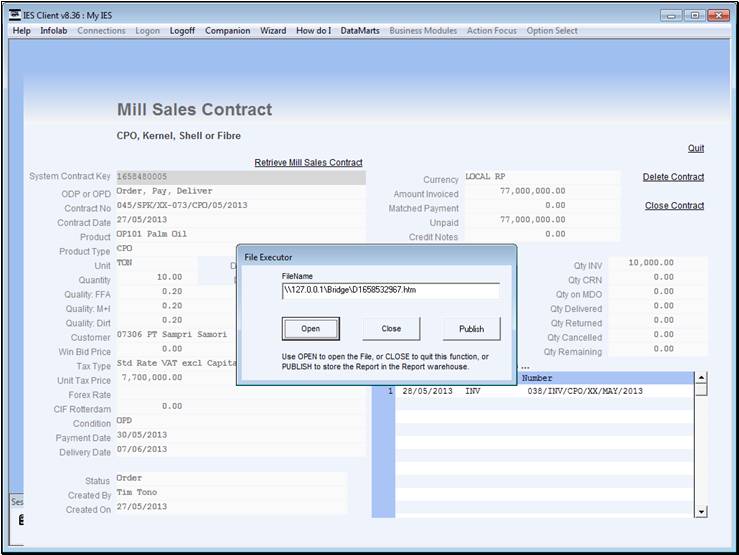

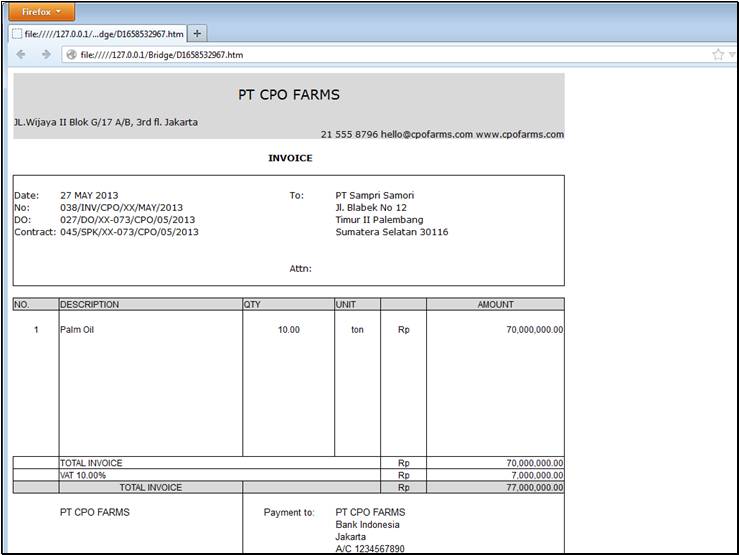

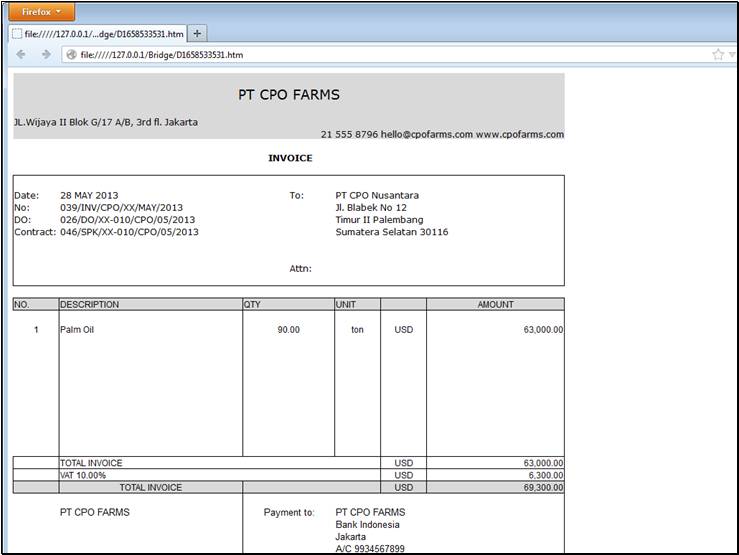

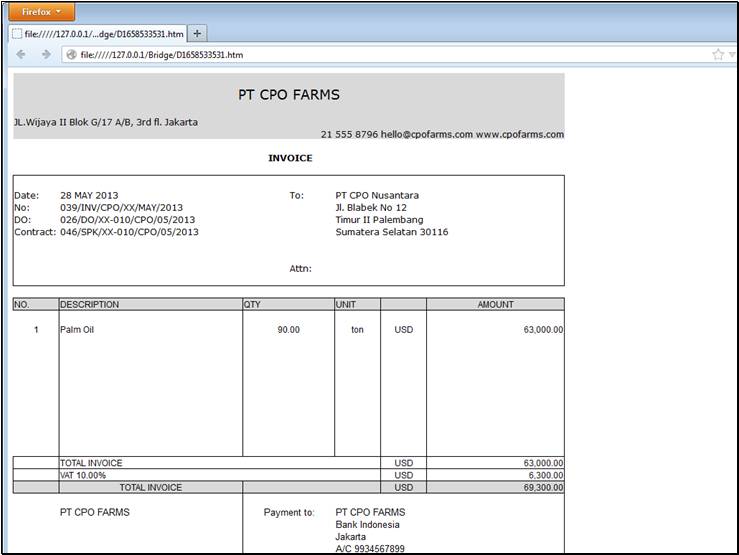

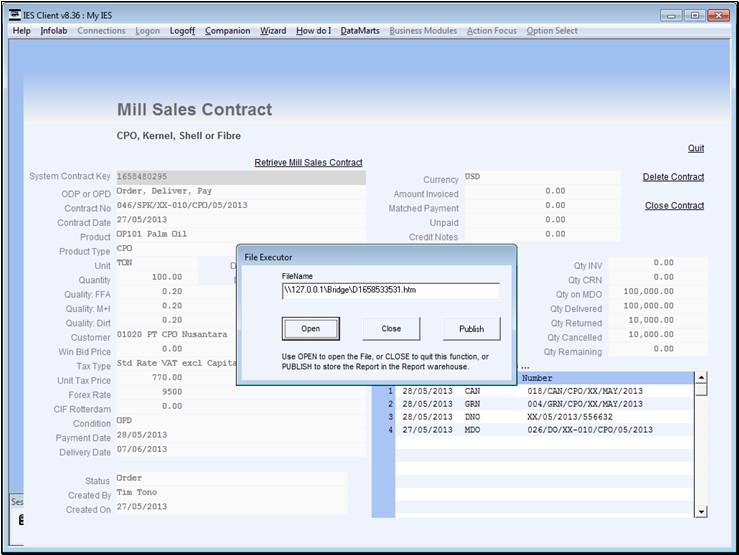

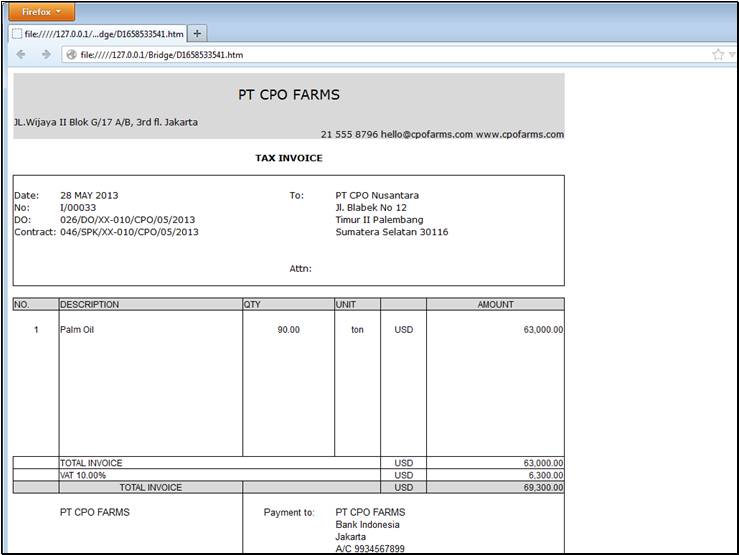

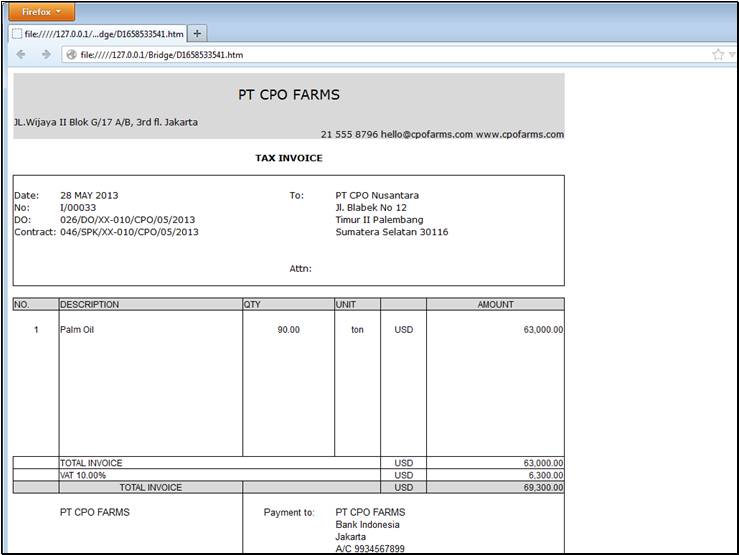

The Extended Invoice is printed first, followed by

the Tax Invoice.

Slide 36 - Slide 36

Slide notes

Slide 37 - Slide 37

Slide notes

Slide 38 - Slide 38

Slide notes

Slide 39 - Slide 39

Slide notes

Slide 40 - Slide 40

Slide notes

Slide 41 - Slide 41

Slide notes

Slide 42 - Slide 42

Slide notes

Slide 43 - Slide 43

Slide notes

Slide 44 - Slide 44

Slide notes

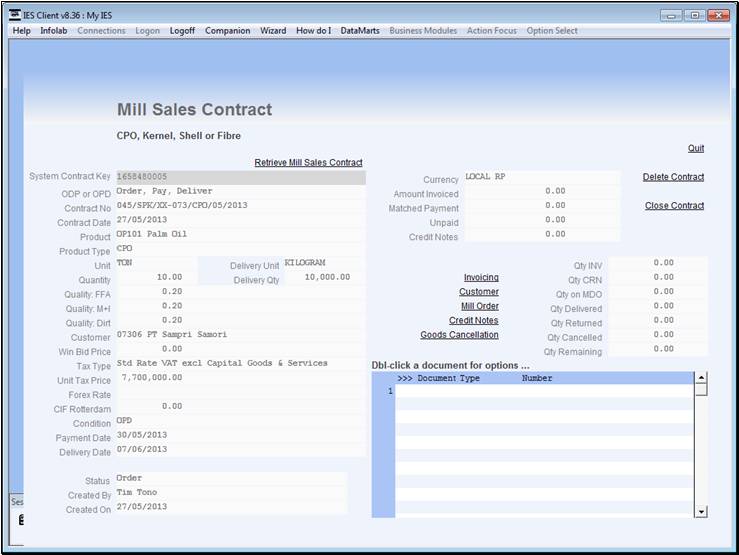

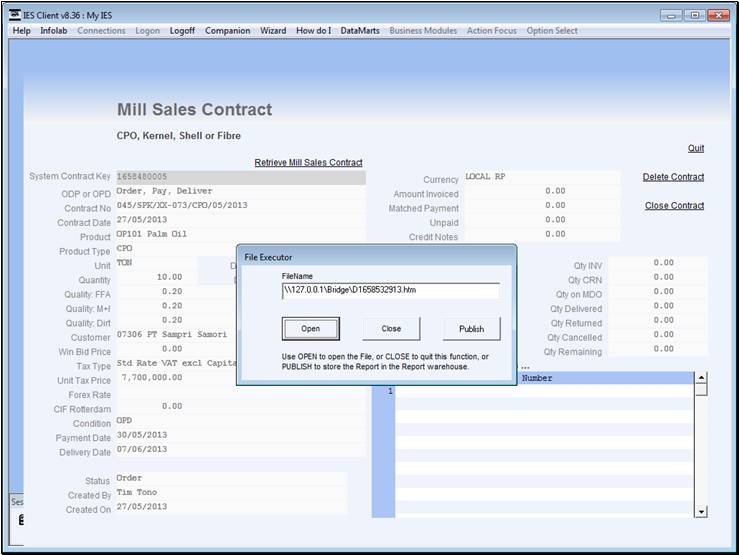

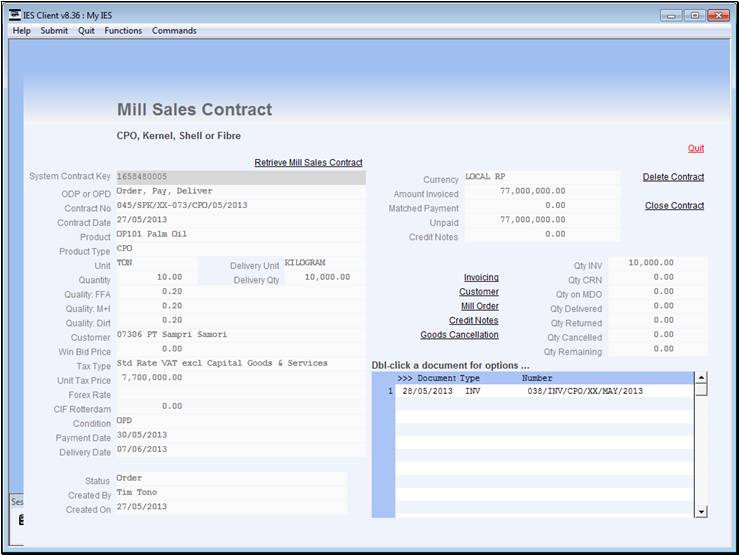

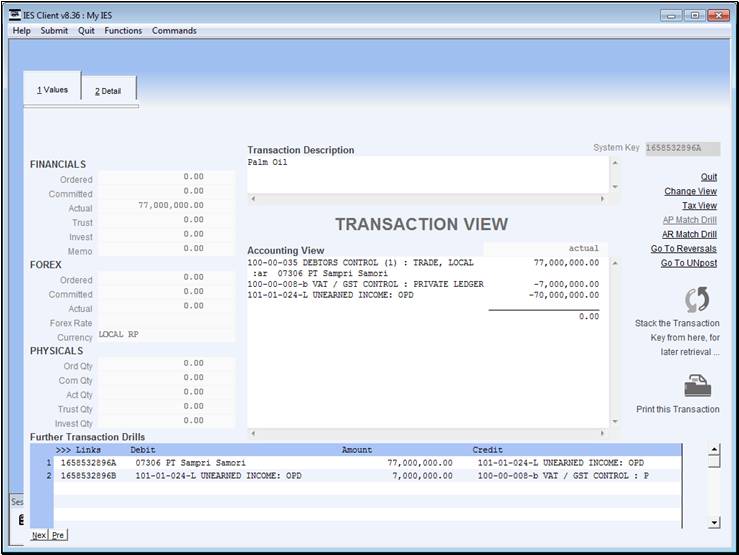

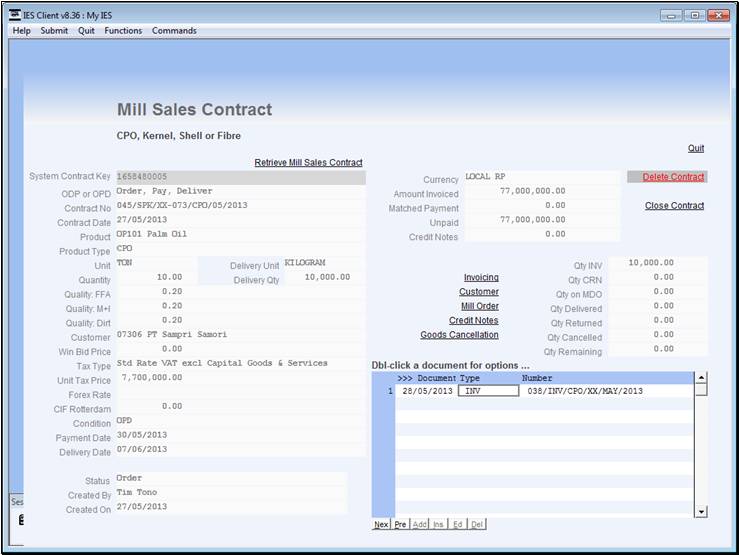

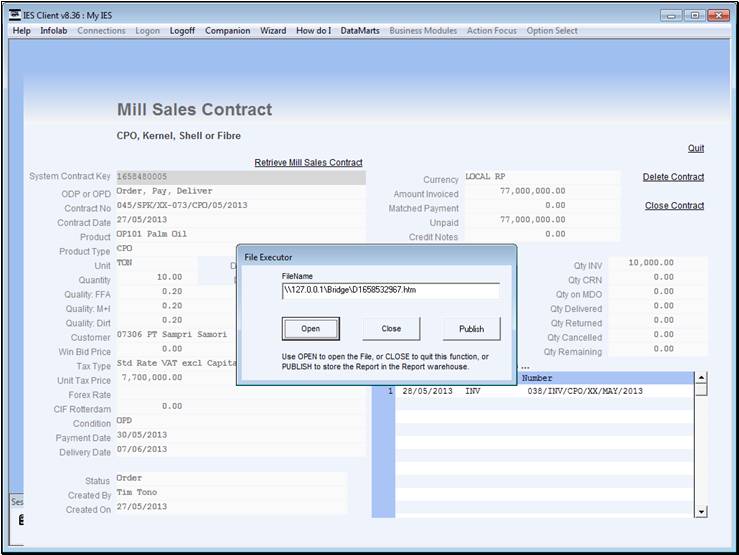

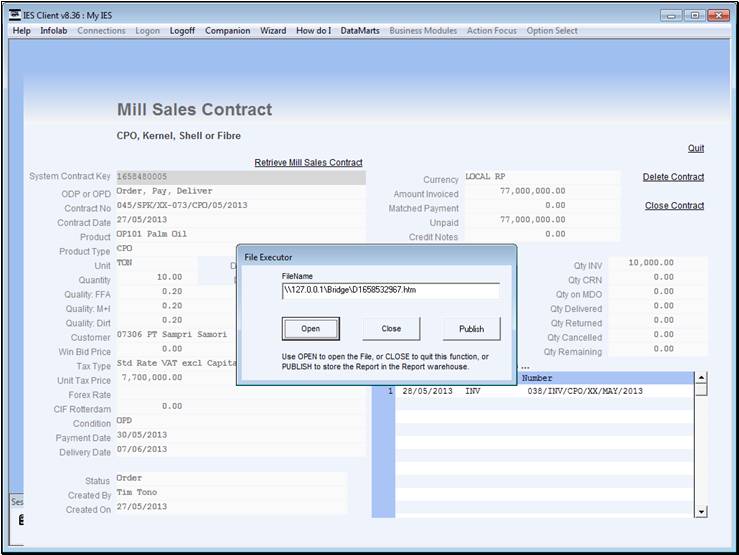

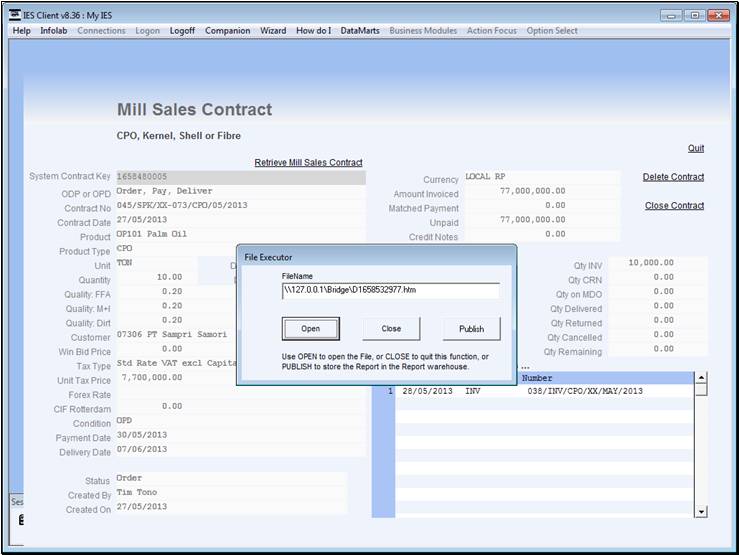

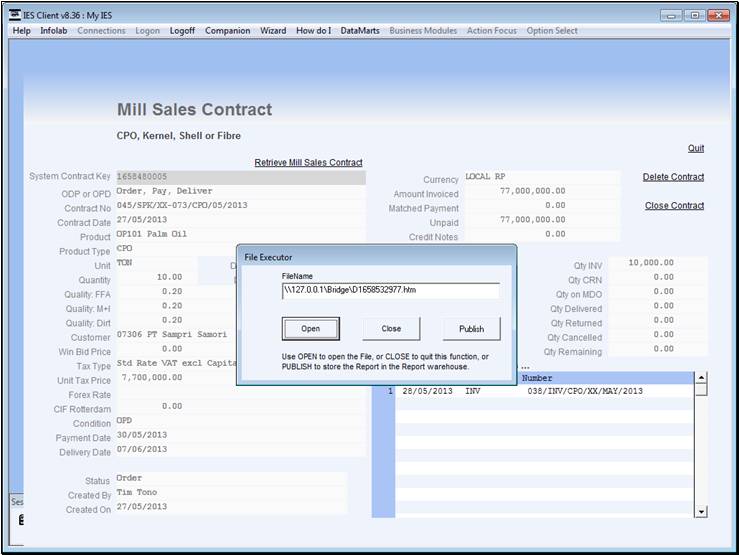

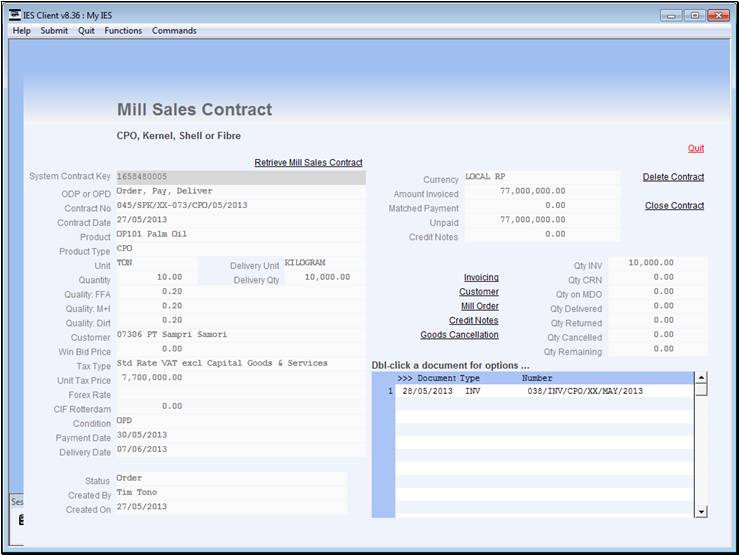

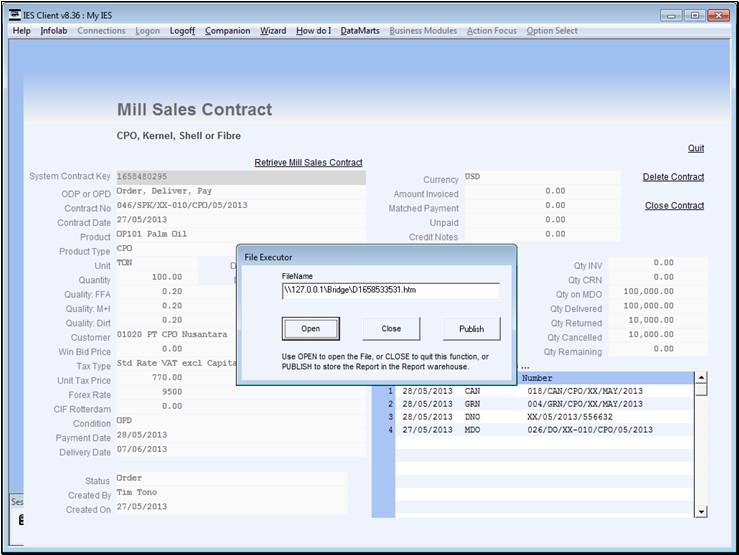

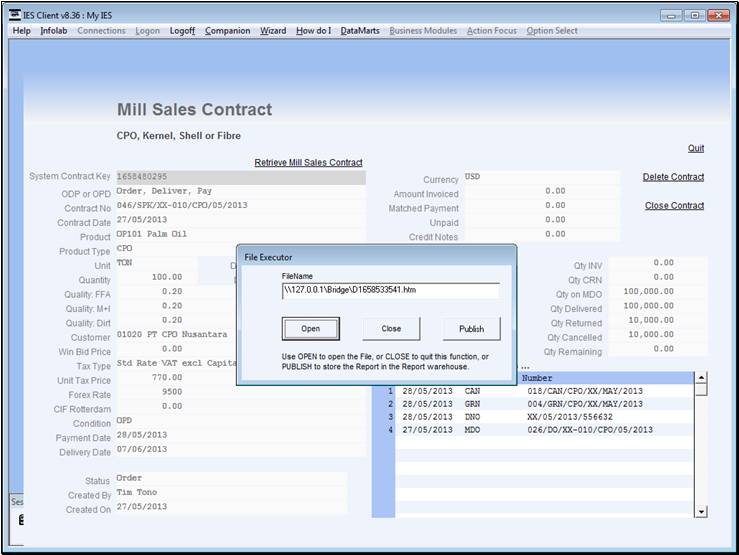

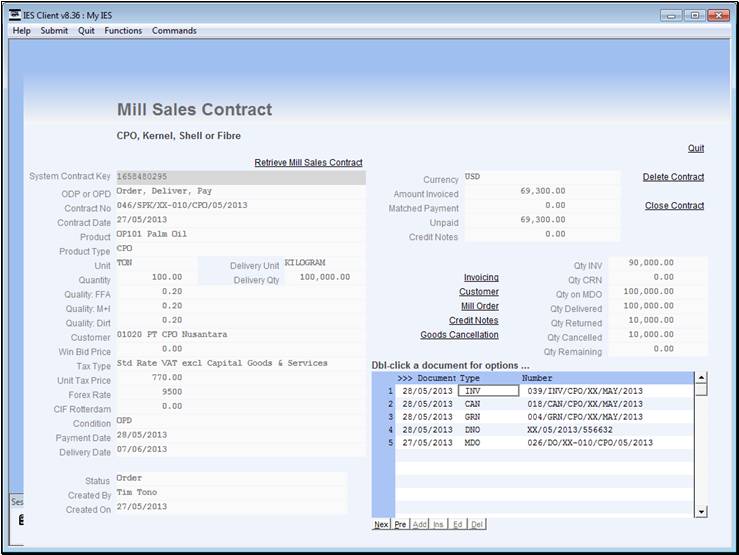

The Invoice immediately appears on the document

list, from where we can re-print the Invoice or drill Transactions.

Slide 45 - Slide 45

Slide notes

Slide 46 - Slide 46

Slide notes

Slide 47 - Slide 47

Slide notes

Slide 48 - Slide 48

Slide notes

Slide 49 - Slide 49

Slide notes

Slide 50 - Slide 50

Slide notes

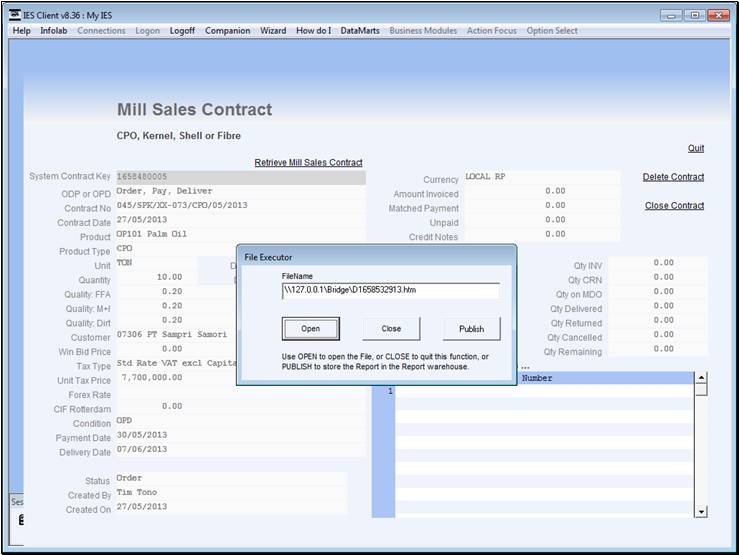

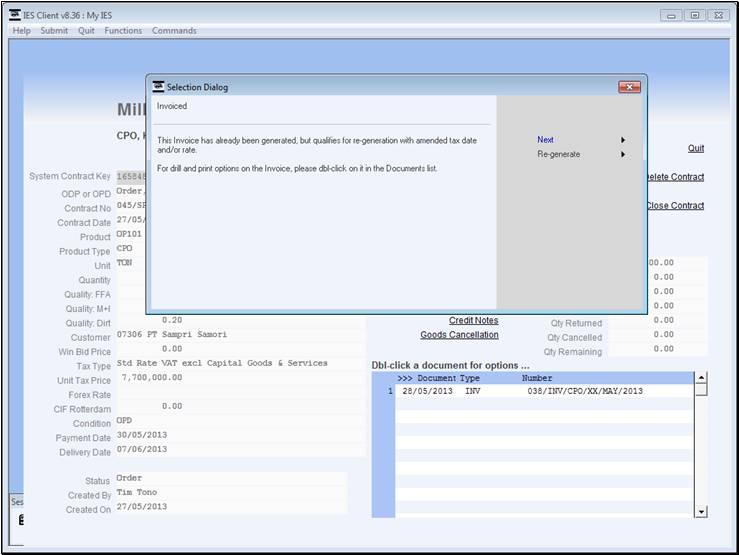

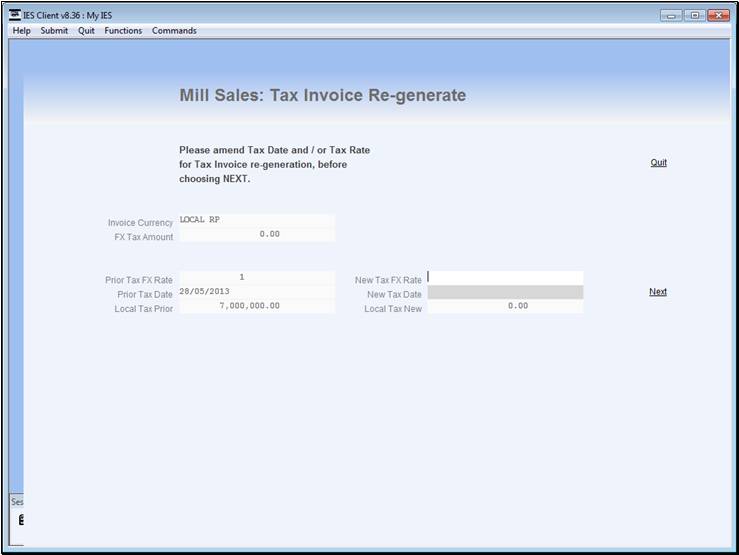

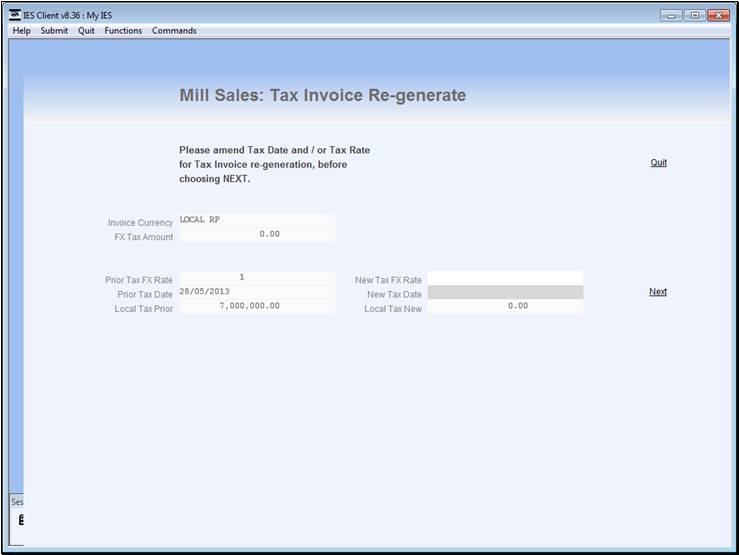

In the event that there is a need to change the Tax

date or the Tax Rate in the immediately following days, we can choose

'Invoicing' again to re-generate the Tax Invoice with the new Date or Rate.

Slide 51 - Slide 51

Slide notes

Slide 52 - Slide 52

Slide notes

Slide 53 - Slide 53

Slide notes

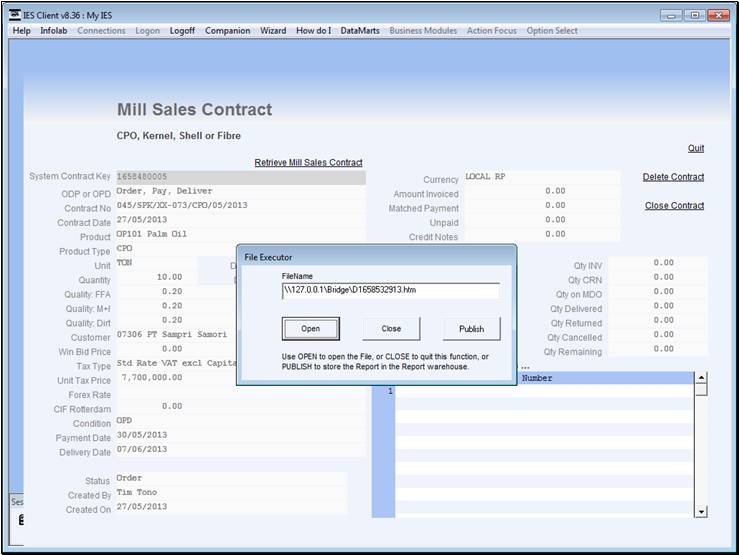

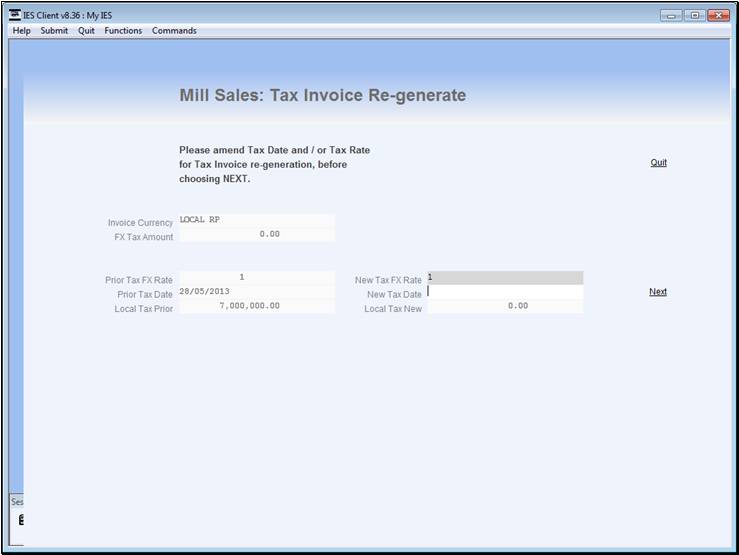

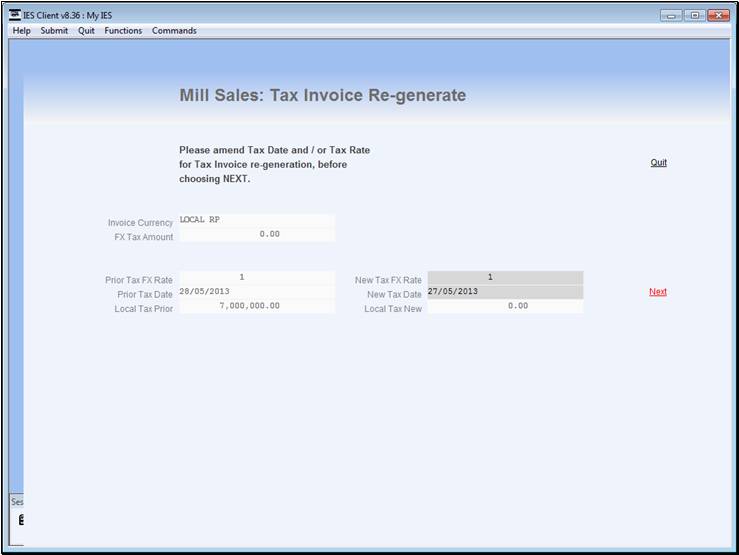

Of course, for a local Currency Contract, the Rate

can only be 1, but for Forex it can be different.

Slide 54 - Slide 54

Slide notes

We choose also the Tax Date to apply.

Slide 55 - Slide 55

Slide notes

Slide 56 - Slide 56

Slide notes

Slide 57 - Slide 57

Slide notes

Slide 58 - Slide 58

Slide notes

Slide 59 - Slide 59

Slide notes

Slide 60 - Slide 60

Slide notes

Slide 61 - Slide 61

Slide notes

Slide 62 - Slide 62

Slide notes

Slide 63 - Slide 63

Slide notes

Slide 64 - Slide 64

Slide notes

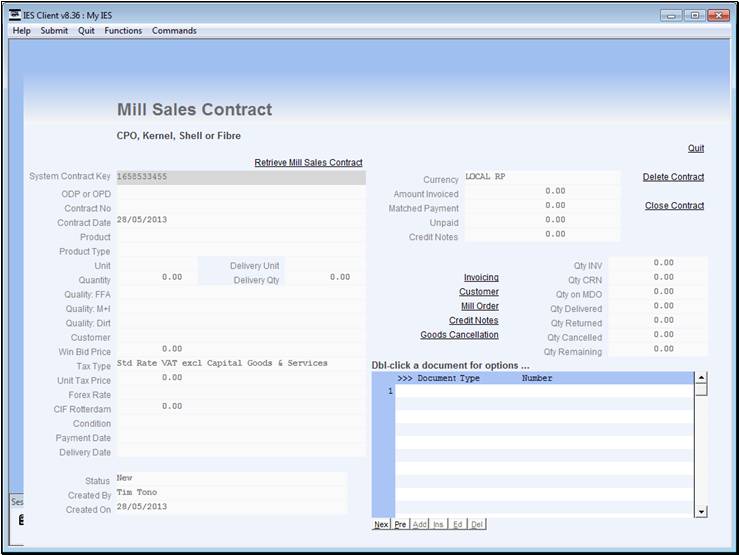

Next, we will perform an Invoice example for an

Order/Delivery/Pay Contract.

Slide 65 - Slide 65

Slide notes

Slide 66 - Slide 66

Slide notes

Slide 67 - Slide 67

Slide notes

Slide 68 - Slide 68

Slide notes

Slide 69 - Slide 69

Slide notes

We can see that the full quantity was delivered,

then some quantity was returned and this quantity was subsequently cancelled.

Slide 70 - Slide 70

Slide notes

Slide 71 - Slide 71

Slide notes

Slide 72 - Slide 72

Slide notes

Therefore, in this case, there is no need for a

Credit Note on the Cancelled quantity, because the Invoice has not been

performed yet, and the system will simply limit the Invoice now to the reduced

amount.

Slide 73 - Slide 73

Slide notes

Slide 74 - Slide 74

Slide notes

The Billing Detail and Payment instruction is

probably already correct, but possible to change.

Slide 75 - Slide 75

Slide notes

Slide 76 - Slide 76

Slide notes

Slide 77 - Slide 77

Slide notes

Slide 78 - Slide 78

Slide notes

Slide 79 - Slide 79

Slide notes

Slide 80 - Slide 80

Slide notes

Slide 81 - Slide 81

Slide notes

Slide 82 - Slide 82

Slide notes

Slide 83 - Slide 83

Slide notes

We will choose the Tax Exchange Rate to apply,

whereas the P and L Rate will already be forced at this stage, due to prior

Transactions on the Contract.

Slide 84 - Slide 84

Slide notes

Slide 85 - Slide 85

Slide notes

Slide 86 - Slide 86

Slide notes

Slide 87 - Slide 87

Slide notes

We can see that the Invoice is for the reduced

number of Tons.

Slide 88 - Slide 88

Slide notes

Slide 89 - Slide 89

Slide notes

Slide 90 - Slide 90

Slide notes

Slide 91 - Slide 91

Slide notes

Slide 92 - Slide 92

Slide notes

Slide 93 - Slide 93

Slide notes

Slide 94 - Slide 94

Slide notes

Slide 95 - Slide 95

Slide notes

Slide 96 - Slide 96

Slide notes

Slide 97 - Slide 97

Slide notes

Slide 98 - Slide 98

Slide notes

Slide 99 - Slide 99

Slide notes

Slide 100 - Slide 100

Slide notes