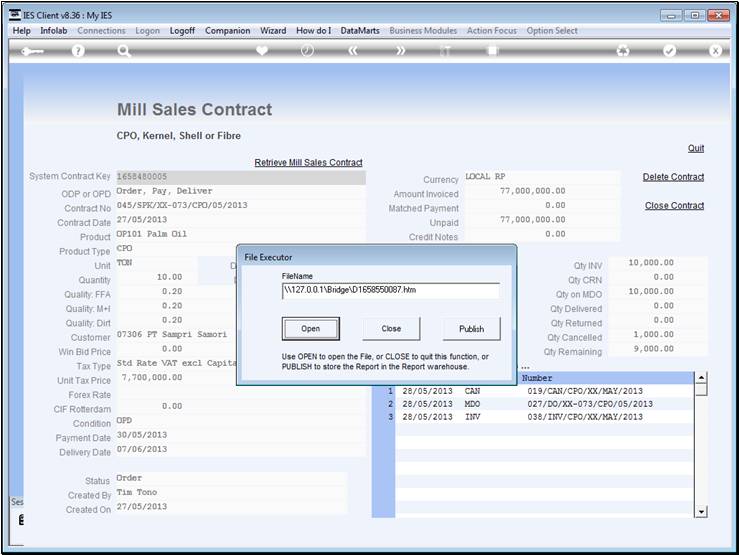

Slide 1 - Slide 1

Slide notes

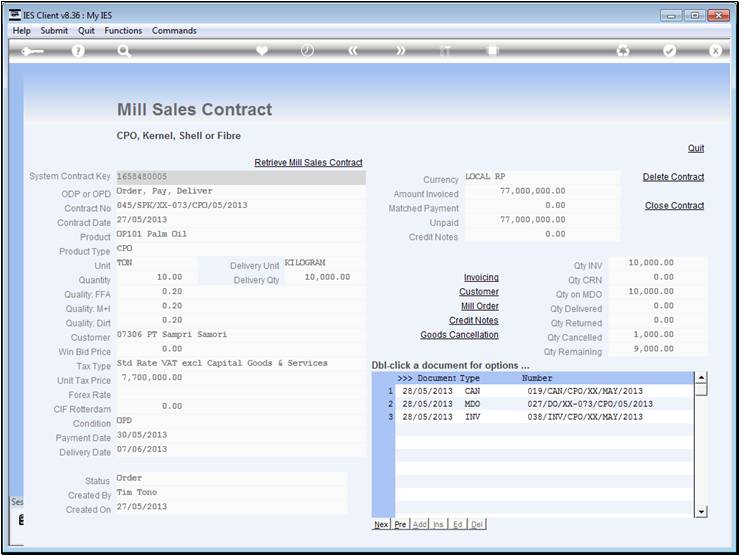

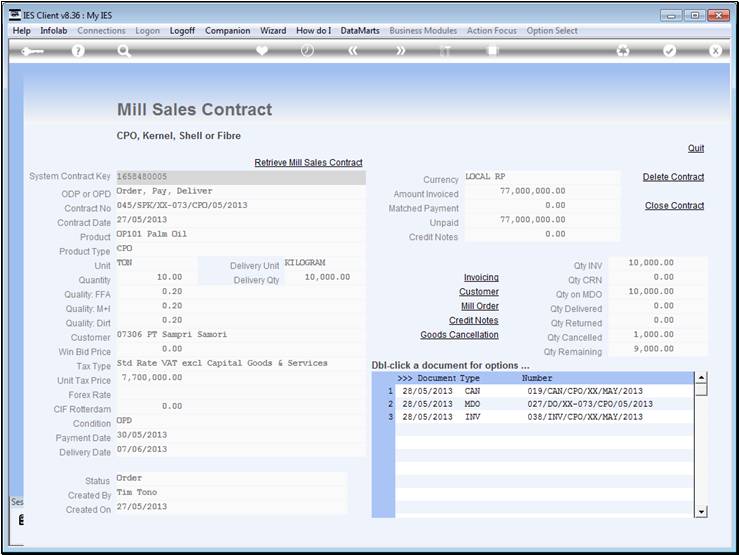

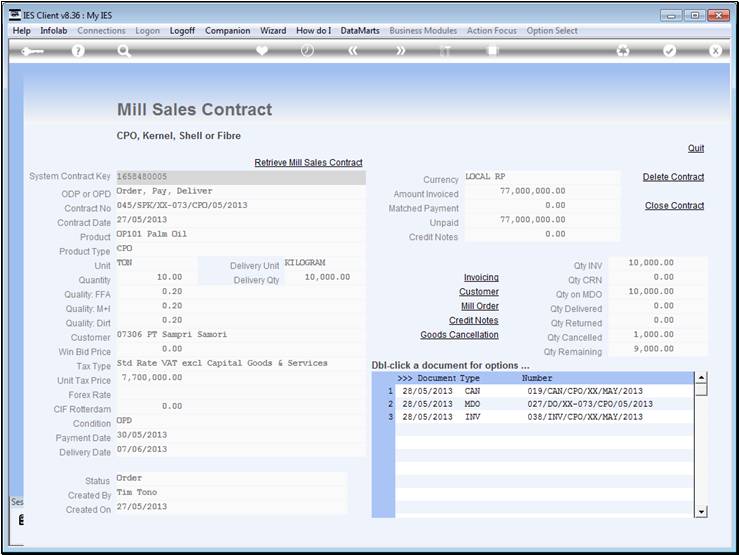

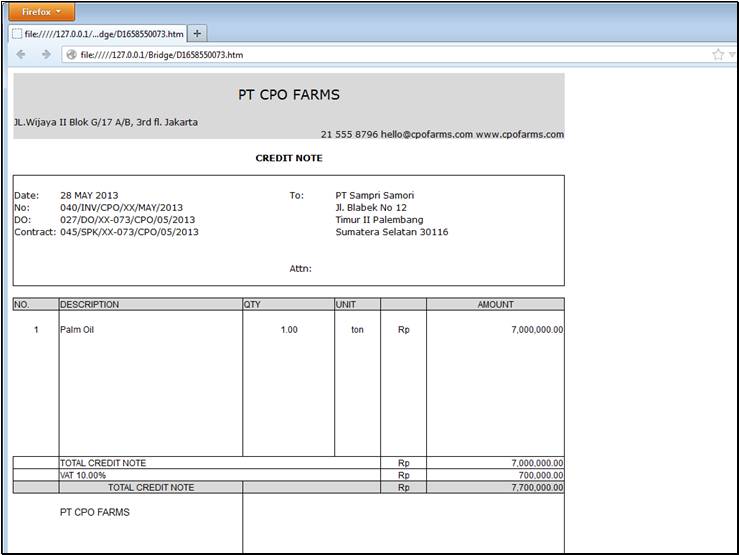

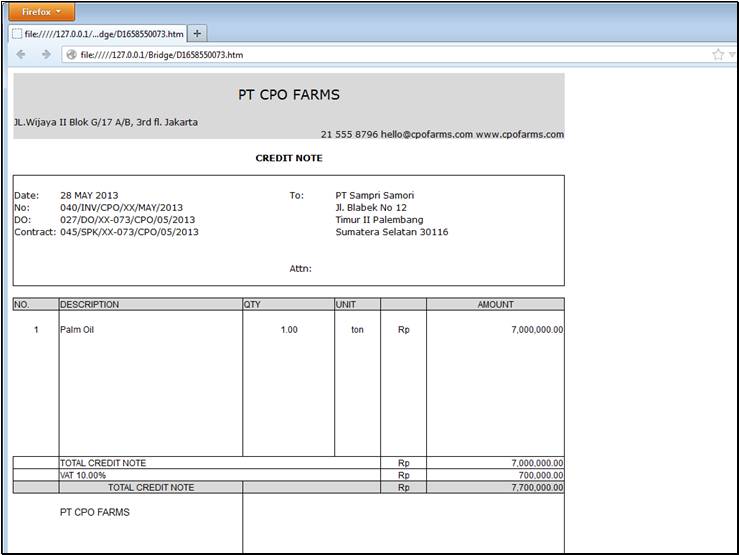

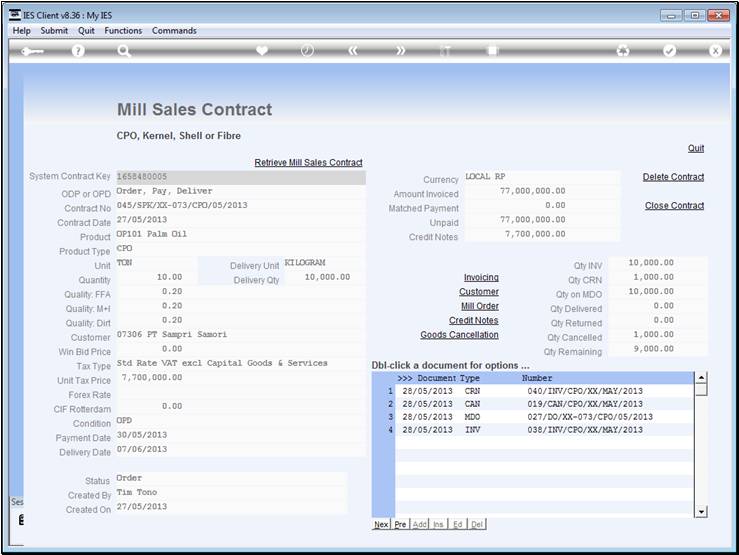

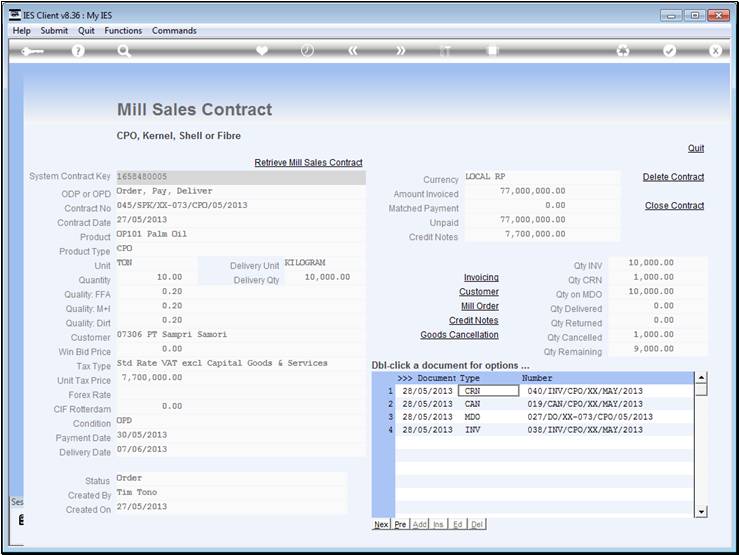

Credit Notes can only be performed for cancelled

quantities.

Slide 2 - Slide 2

Slide notes

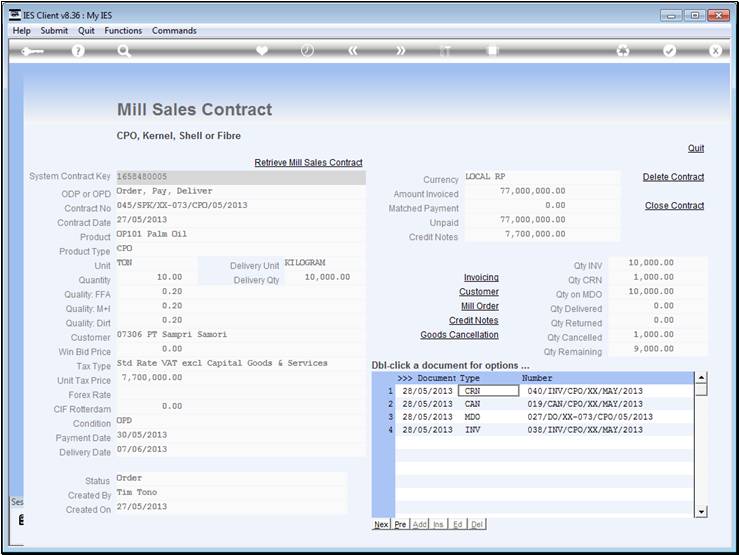

Slide 3 - Slide 3

Slide notes

Slide 4 - Slide 4

Slide notes

Slide 5 - Slide 5

Slide notes

Slide 6 - Slide 6

Slide notes

Slide 7 - Slide 7

Slide notes

Slide 8 - Slide 8

Slide notes

Slide 9 - Slide 9

Slide notes

Slide 10 - Slide 10

Slide notes

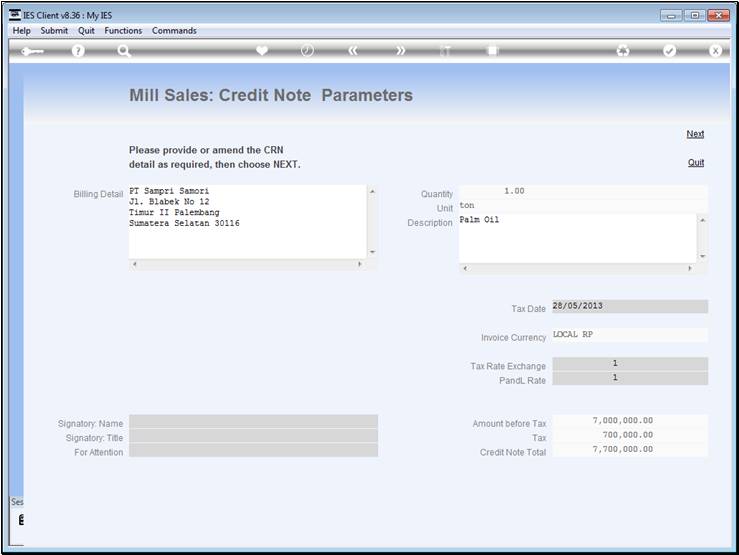

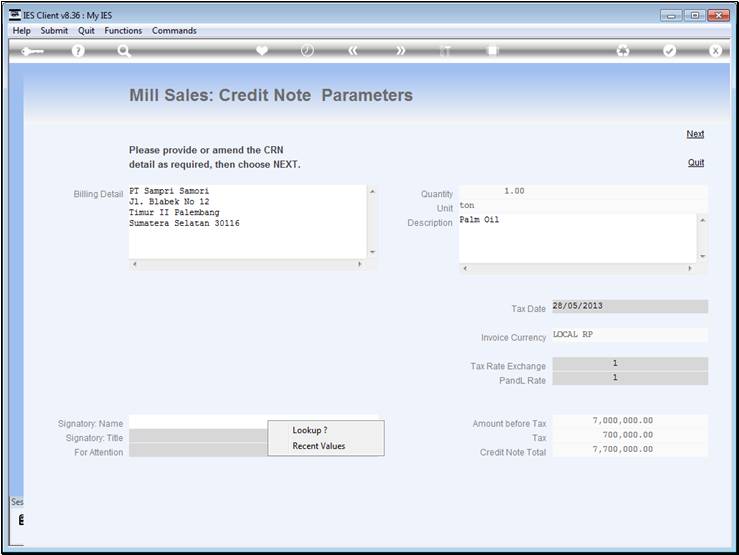

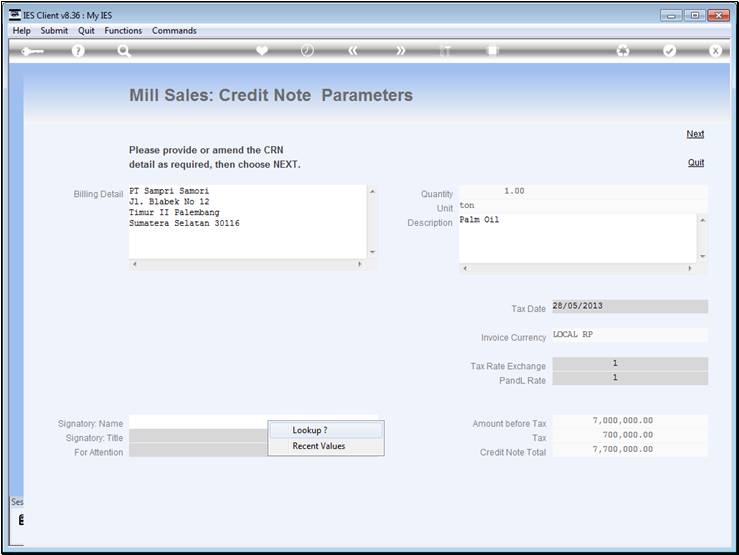

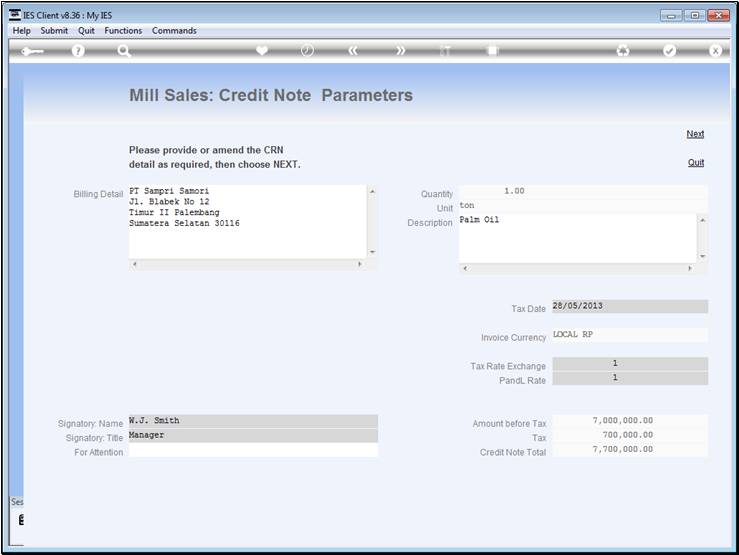

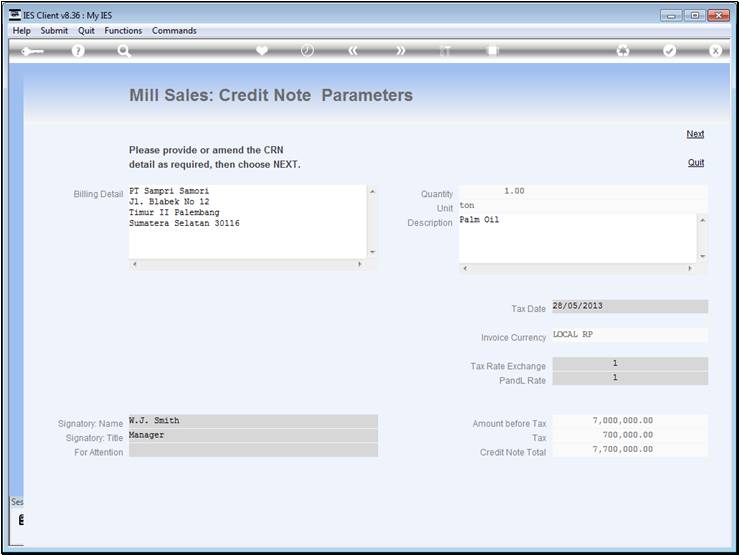

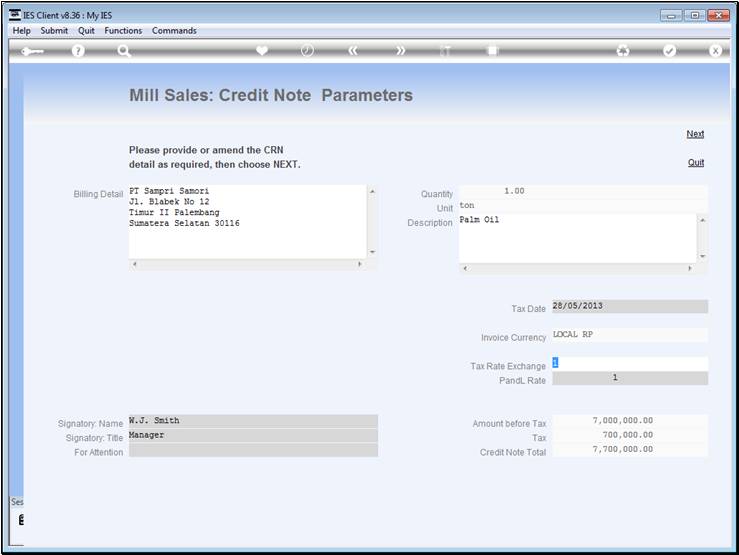

The Tax Exchange Rate must be supplied when it is a

Forex Credit Note, whereas in the case of Local Currency the Rate is

automatically = 1.

Slide 11 - Slide 11

Slide notes

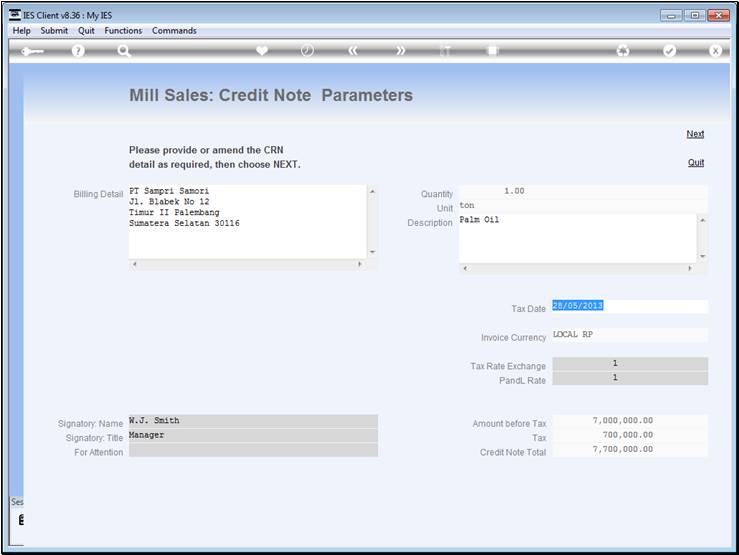

The Tax Date may be changed.

Slide 12 - Slide 12

Slide notes

Slide 13 - Slide 13

Slide notes

Slide 14 - Slide 14

Slide notes

Slide 15 - Slide 15

Slide notes

Slide 16 - Slide 16

Slide notes

Slide 17 - Slide 17

Slide notes

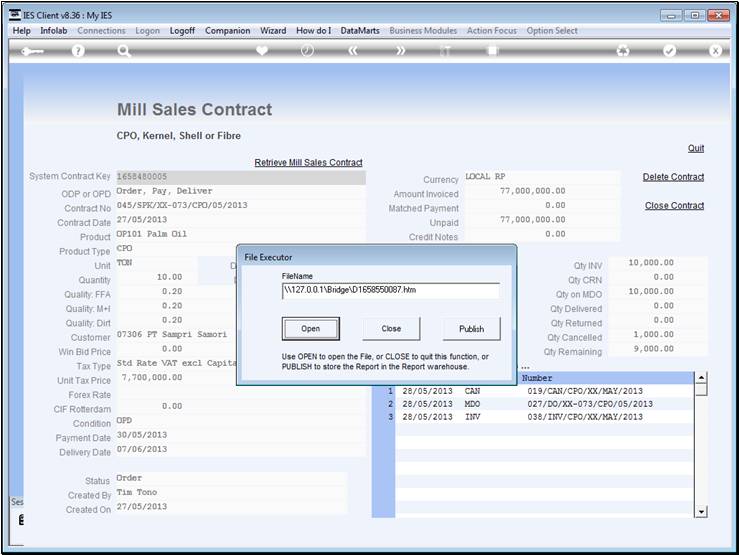

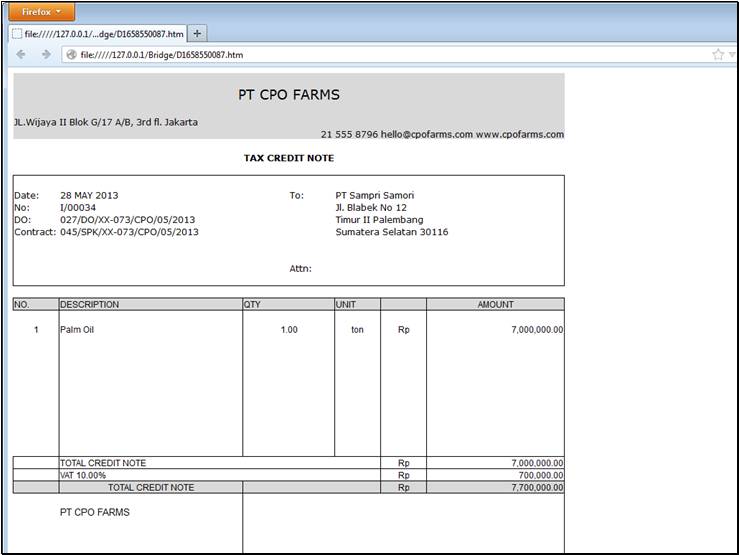

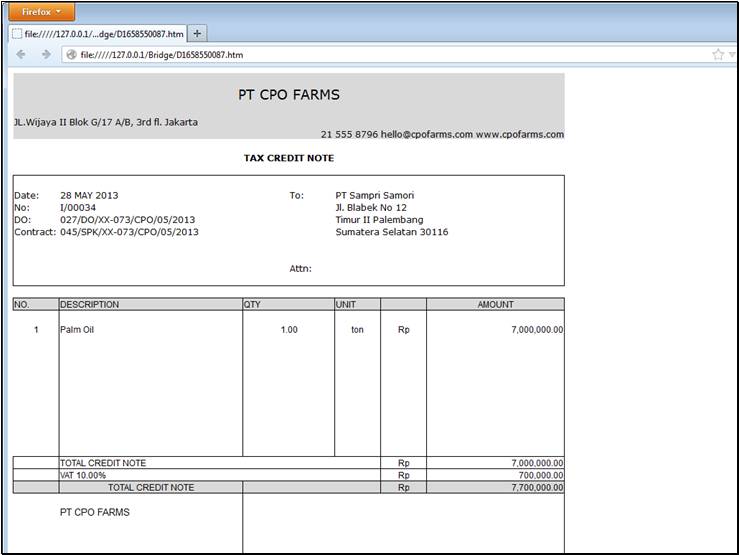

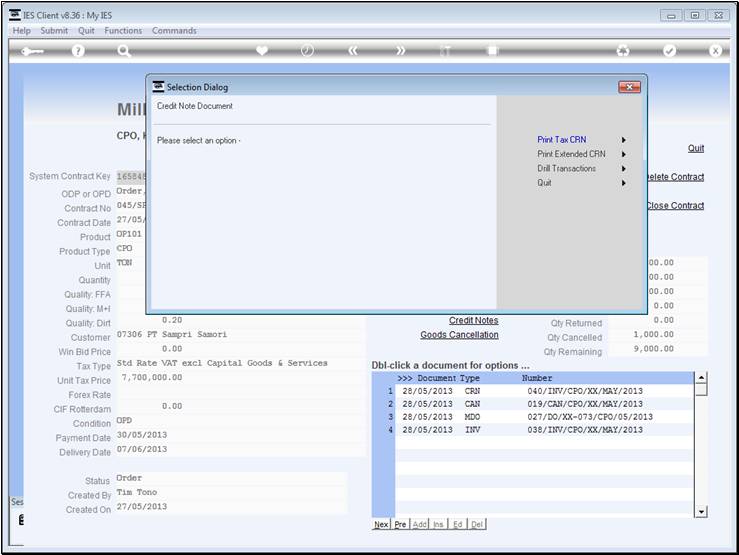

Similar to the Invoices, there is an extended

Customer Credit Note, followed by a Tax Credit Note.

Slide 18 - Slide 18

Slide notes

Slide 19 - Slide 19

Slide notes

Slide 20 - Slide 20

Slide notes

Slide 21 - Slide 21

Slide notes

Slide 22 - Slide 22

Slide notes

Slide 23 - Slide 23

Slide notes

Slide 24 - Slide 24

Slide notes

Slide 25 - Slide 25

Slide notes

Slide 26 - Slide 26

Slide notes

Slide 27 - Slide 27

Slide notes

Slide 28 - Slide 28

Slide notes

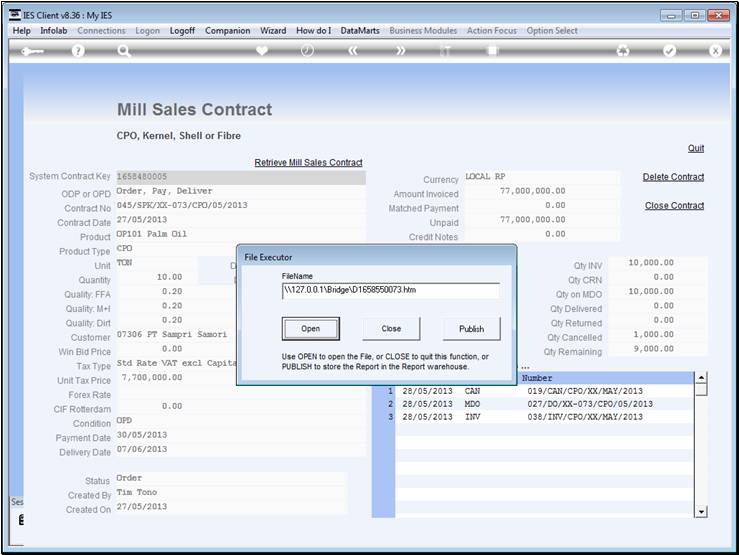

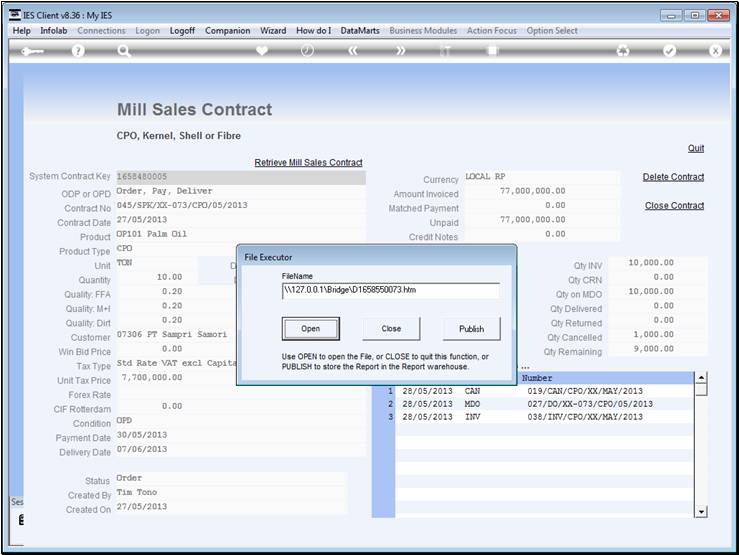

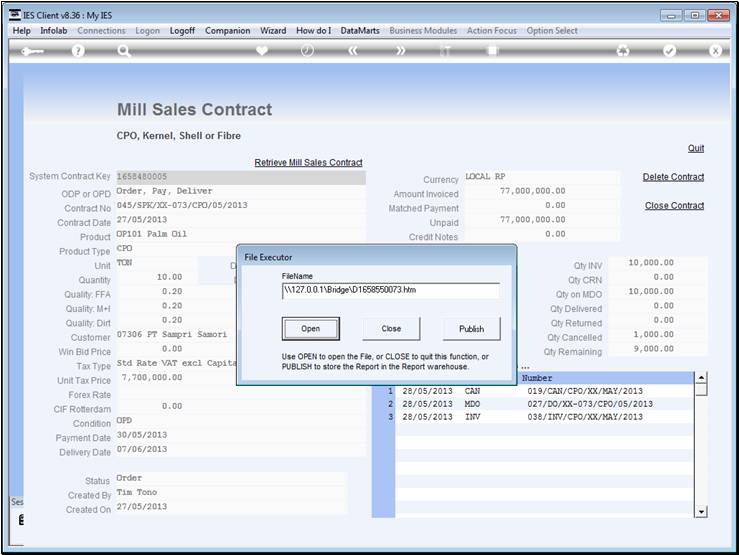

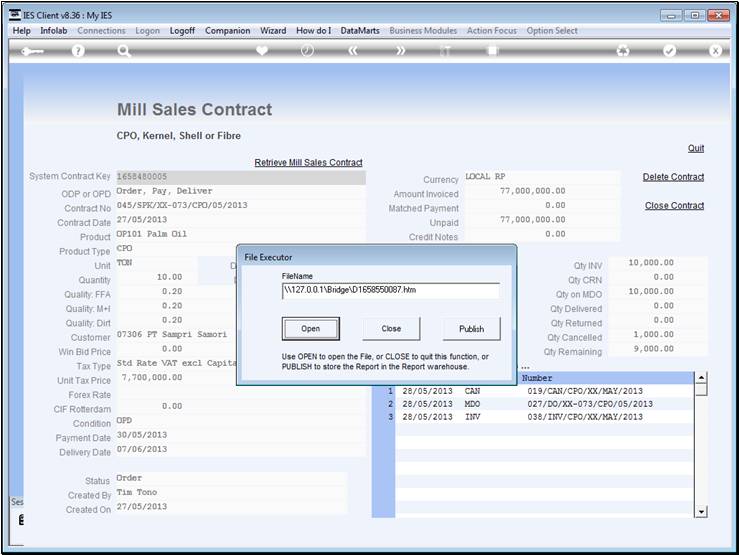

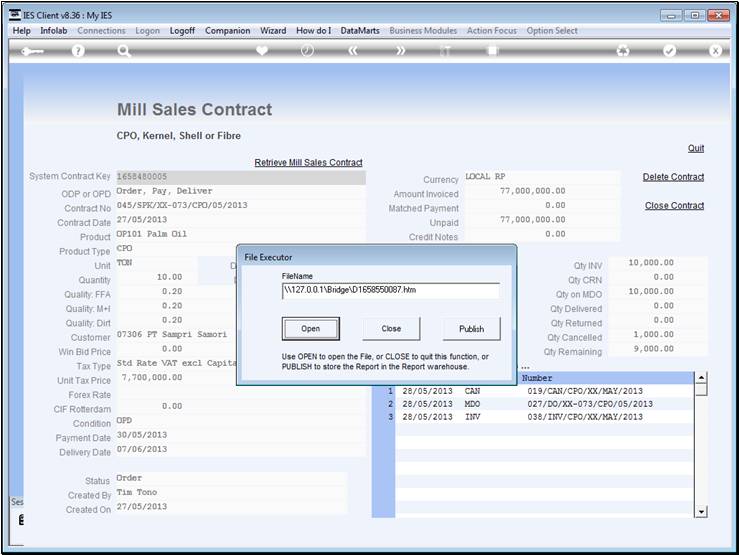

Once the Credit Note appears at the Document list

for this Contract, we can do re-prints and drill Transactions if we wish to.

Slide 29 - Slide 29

Slide notes